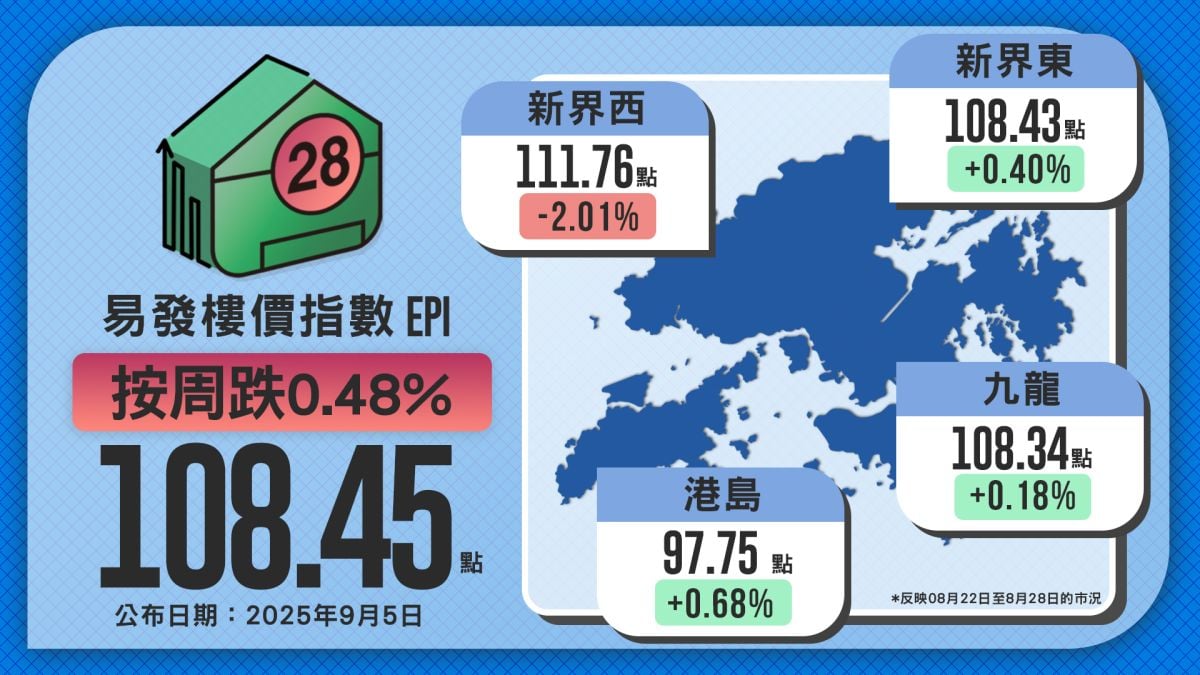

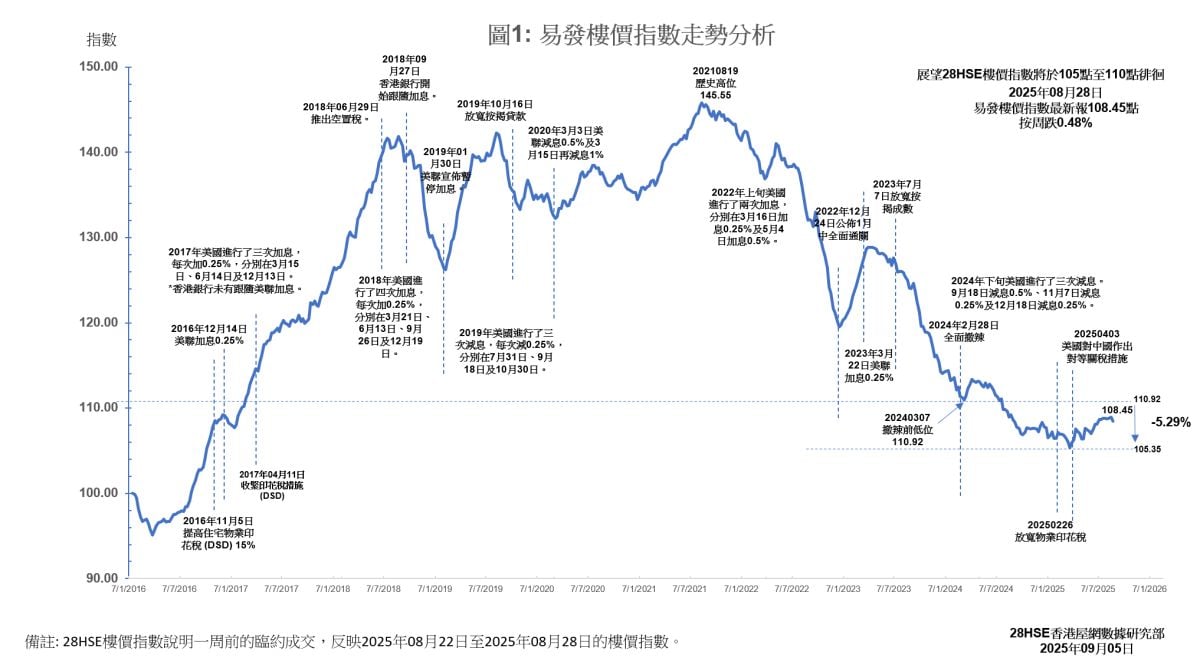

Hong Kong’s property market continues to fluctuate. The Eva Property Index stands at 108.45 points, down 0.48% week-on-week, though still up 1.4% year-to-date, but more than 32% lower than its 2021 peak. Primary-market sales remain strong, with around 190 units sold in late August, while the secondary market is under pressure. Across regions, the index shows a “three up, one down” pattern, with New Territories West dragging the overall market after three consecutive weeks of decline. On rentals, strong demand pushed the Eva Rental Index up to 116.88 points, the highest this year, and it is expected to hover at high levels in the short term.

Property Prices: Short-Term Fluctuations Amid Rate Pressure

Recently, Hong Kong’s property market has been volatile. The latest property price index dropped 0.48% week-on-week, ending two consecutive weeks of gains. Despite being up 1.4% this year, it is still over 32% below 2021 highs. Market hopes rest on a possible U.S. Fed rate cut in September and local policy “sweeteners” in the upcoming Policy Address, which may lift the index above 109 points in the short term.

However, high interest rates continue to exert pressure. The one-month HIBOR, linked to mortgage rates, has risen for three straight days, reaching 3.31% on August 28, 2025. With mortgage pricing at H+1.3%, the actual mortgage rate hits 4.61%, exceeding the 3.5% cap. For a HK$4 million loan over 30 years, monthly payments at the capped rate are about HK$18,127, which is HK$2,676 more than when rates were at about 2.26%, dampening buyer appetite.

New Projects Attract Buyers, Secondary Market Struggles

The primary market remains vibrant, siphoning demand from the secondary market. Over the weekend of August 23–24, projects including “Blue Coast II” in Wong Chuk Hang, “The Verdancy” in Yuen Long, “The Haddon” in Hung Hom, and “Double Coast I” in Kai Tak recorded about 190 transactions, nearly doubling the previous week. Developers successfully lured buyers with flexible payment plans and discounts. However, strong primary sales suppressed secondary transactions, which are unlikely to rebound significantly in the short term. Looking ahead, property prices will hinge on interest rate movements and policy support. If external rate cuts and favorable local policies materialize, the market could rise steadily; otherwise, prices may remain under downward pressure in 2026.

Regional Indices: “Three Up, One Down,” NT West Still Weak

The regional breakdown shows a “three up, one down” trend.

New Territories West saw the sharpest decline, at 111.76 points, down 2.01% week-on-week, and has now fallen for three consecutive weeks. Owners’ reluctance to sell, coupled with hopes for supportive policies, has left the secondary market in stalemate.

Hong Kong Island rose to 97.75 points (+0.68%), marking a four-week rise.

New Territories East rebounded to 108.43 points (+0.4%), back to levels seen two weeks ago.

Kowloon climbed to 108.34 points (+0.18%), up for the second week.

Overall, Hong Kong Island and Kowloon show steady recovery, New Territories East has slightly rebounded, while New Territories West remains in correction mode.

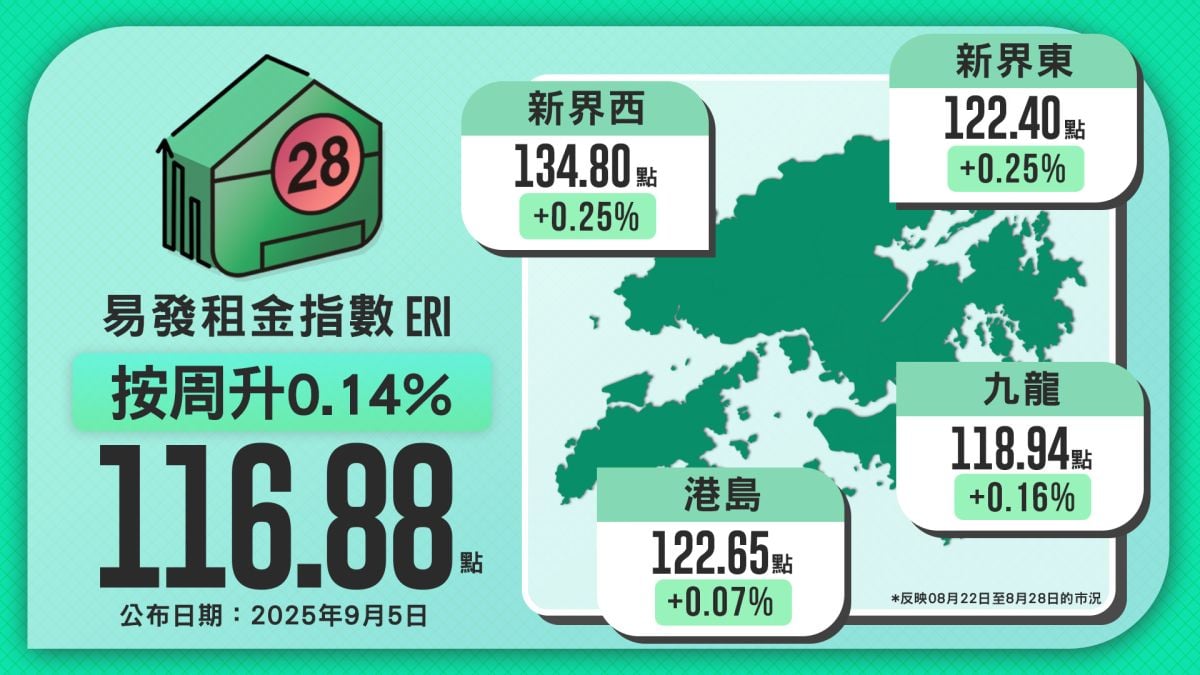

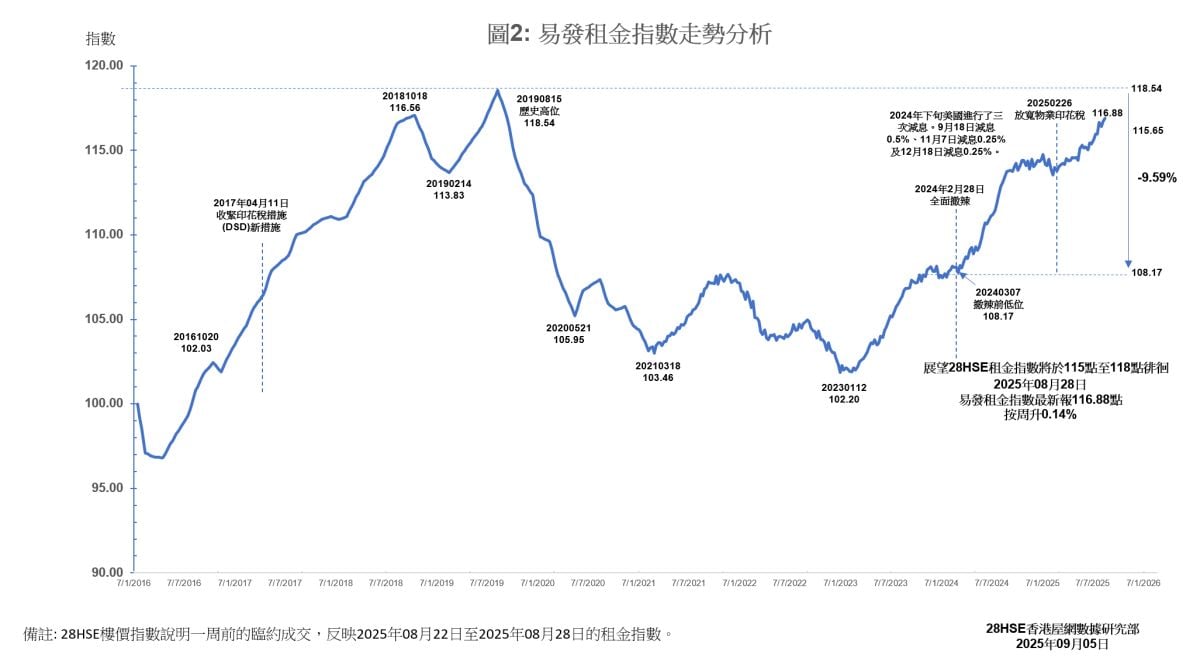

Rental Market: Year-High Levels, Short-Term Stability Expected

Hong Kong’s rental market remains robust. With the leasing peak season nearing its end, demand from students and families ahead of the new school year continues to push rents higher. The latest rental index is 116.88 points, up 0.14% week-on-week, setting a new year-high.

All four regions saw gains:

New Territories East: 122.4 points (+0.25%), up for the fourth consecutive week.

New Territories West: 134.8 points (+0.25%), reversing declines.

Kowloon: 118.94 points (+0.16%).

Hong Kong Island: 122.65 points (+0.07%), close to the historical high of 122.81 points.

Looking ahead, rents may soften slightly as the summer peak ends, but sustained demand from students and expatriate professionals should keep levels high. The index is expected to fluctuate between 115 and 118 points over the next two months.

This week's index reflects the market conditions from August 22, 2025 to August 28, 2025.

Like