The situation is turbulent and the stock market is faltering, making CCL to fall 1.34% in one week, the most decline in three months.

(by Li Zitian)

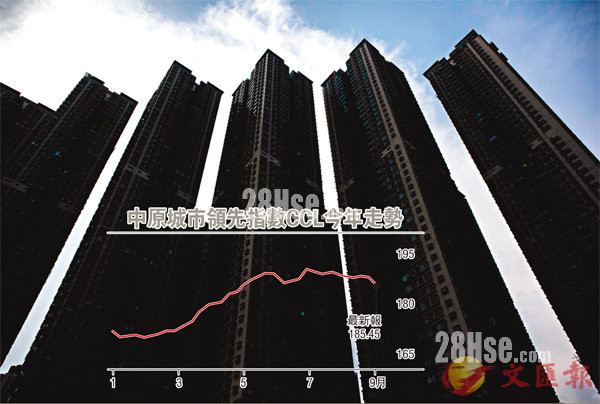

In recent months, the political situation has been turbulent and the stock market has been faltering in Hong Kong, suppressing the confidence of the property market, and transactions including price cut up to one million HKD increase, which has accelerated the decline in second-hand property prices. The Centaline property price index, which reflects the trend of second-hand property prices in Hong Kong, has accelerated, with the latest eight leading indexes in this week have fallen for two weeks, and it is the first time since November last year. Among them, the Centa-City Leading Index (CCL) is reported at 185.45 points, down 1.34% per week, and it is the biggest decline for nearly 12 weeks. The analysis predicts that property prices would return to the level at the beginning of the year.

According to the announcement of Centaline Property, the latest CCL is reported at 185.45 points, a new low of 18 weeks and down 1.34% per week, also it is the biggest decline in 12 weeks. The Mass Centa-City Leading Index(CCL Mass) is 187.14 points, a new low in 18 weeks and down 1.45% per week, also it is the biggest decline in 34 weeks. The CCL (small and medium units) is 185.82 points, a new low in 18 weeks and down 1.34% per week, also it is the biggest decline in 12 weeks. The CCL (large units) is 183.58 points, a new low in 17 weeks and down 1.32% per week, also it is the biggest decline in 5 weeks.

This year's increase narrowed to 5.9%.

From the high of 190.48 points in the week at the end of June this year, CCL has dropped 2.64% so far; but CCL still has risen 5.91% from 174.49 points of the week at the end of last year.

The Senior Co-director of Centaline Research Department, Woo LeungSing points out that, the eight leading CCL indexes have fallen together in two weeks, which is the first time to see in 40 weeks. It is expected that the property price will significantly adjust downwards before the Mid-Autumn Festival, ending the narrow reversal in the previous seven weeks. However, he believes that the property market would not turn downward sharply and property prices are estimated to return to the level of this year. In the past two weeks, CCL has fallen by 1.56%, CCL Mass has fallen by 1.71%, CCL (small and medium-sized units) has fallen by 1.60%, CCL (large units) has fallen by 1.36%, Hong Kong Island has fallen by 1.17%, Kowloon has fallen by 3.43%, New Territories East has fallen by 0.76 %, and the New Territories West has fallen by 0.42%.

CCL, CCL Mass and CCL (small and medium units) also have fallen for two weeks by 1.56%,1.71% and 1.60% respectively. CCL (large units) has fallen by1.46% for three weeks, and the prices of luxury homes have fallen for three weeks, the first time in 28 weeks.

As for four districts, Kowloon CCL Mass is 181.59 points, a new low in 20 weeks and down 3.04% per week, and it is the biggest decline in 67 weeks, with totally of 3.43% in two consecutive weeks. The New Territories West CCL Mass is 167.49 points, a new low in 17 weeks and down 0.12% by week, with totally 3.12% in five weeks, also the consecutive decline in five weeks is the first time to see in 37 weeks. Hong Kong Island CCL Mass is 195.09 points, a new low in 7 weeks and down 0.98% per week, also it is the biggest decline in 7 weeks, with totally of 1.17% in two consecutive weeks. New Territories East CCL Mass is 198.46 points, a new low in 4 weeks and down 0.72% per week, also it is the biggest decline in 5 weeks, with totally of 0.76% in two consecutive weeks.

Midland: New Territories property prices fell the most.

The other civil Property Price Index “Midland Property Price Index” has fallen for 6 weeks, and the latest data from August 28 to September 3 was 170.61, down about 1.15% per week, while it was about 1.86% lower than that in four weeks ago. At present, it is about 3.54% lower than the high record, and the cumulative increase in property prices so far this year has further narrowed to 5.96%. Base on three districts of Hong Kong Island, Kowloon and the New Territories, the property prices in three districts all fell, with the New Territories had the most decline. The latest Midland Property Price Index in New Territories is 160.65 points, down about 1.54% weekly, and it is about 2.38% lower compared with data of four weeks ago, while the cumulative increase of property prices in this district so far this year has further narrowed to about 5.82%.

As for Kowloon, the latest Midland Property Price Index is 164.47 points, down about 1.03% weekly, and it is about 1.49% lower compared with data of four weeks ago, while the cumulative increase of property prices in this district so far this year has further narrowed to about 6.97%. The latest Midland Property Price Index in Hong Kong Island is 186.25 points, down about 0.26% weekly, and it is about 0.53% lower compared with data of four weeks ago, while the cumulative increase of property prices in this district so far this year has further narrowed to about 5.1%.