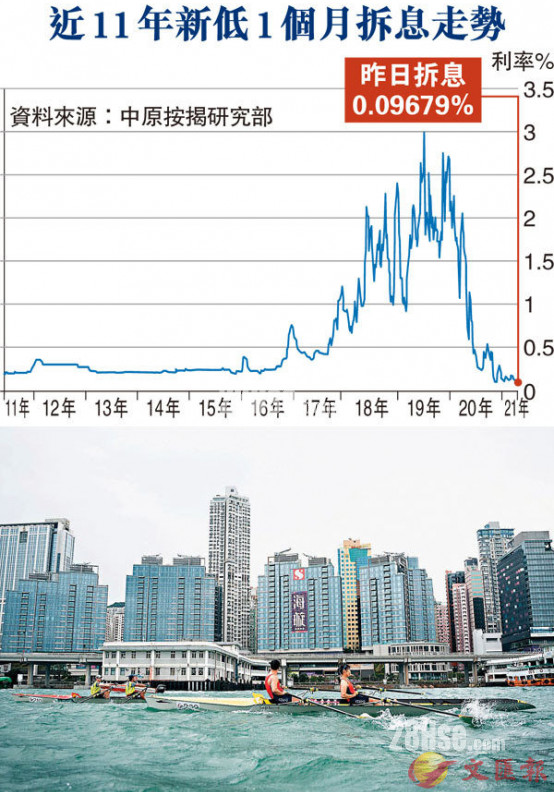

The Hong Kong bank interest rate has recently fallen to a very low point. According to the Treasury Market Association's webpage, the one-month interest rate related to property mortgages fell below 0.1% to 0.09679%, down about 0.61 pips, a record low in nearly 11 years. In this case, taking a loan amount of 4 million yuan, a term of 25 years, and H+1.3% as an example, the monthly payment is 15,805 yuan, which is 2,140 yuan or 11.9% over the same period last year. According to the industry, ample funds in Hong Kong are the main reason for pushing down interest rates. It has been more than half a year since the balance of the banking system in Hong Kong has exceeded the historical high of 450 billion yuan. It is expected that interest rates will continue to fluctuate around 0.1% and continue to provide positive support to the property market. reporter Yan Lunle

If you open the mortgage payment bills in recent months, if you use the Interbank Offered Rate (HIBOR) plan, you will find that the monthly payment is greatly reduced. The reason is that the interest rate in recent months has been hovering at a low level. It is understood that yesterday's 1-month interest rate related to housing mortgages fell further to 0.09679%, and fell below 0.1%, a record low in nearly 11 years since May 4, 2010 (0.09%).

Abundant market funds push down interest rates

Wang Meifeng, the managing director of Centaline Mortgage, responded that the one-month dividend rate continued to fall from 0.12661% on April 7 to 0.09679% yesterday. Abundance of funds was the main reason for pushing down the interest rate. In the past, the average one-month interest rate fell to a historical low of 0.06% in 2009. Bank balances that year exceeded 200 billion to 300 billion yuan. However, under a global volume environment, the balance of the Hong Kong banking system exceeds a record high of 450 billion yuan. The level has been more than half a year.

Since Hong Kong mortgagers mainly use H mortgages, the newly approved H is as high as 95.9%. The drop in interest rates means that the actual market interest rate has fallen further. The actual market interest rate in the first quarter of this year is about 1.46%. The current interest rate has fallen to 1.397%, and the monthly interest expense for monthly payment has been continuously reduced by about 4.3%. This will help reduce the burden on property owners, support the property market, and boost buyers' confidence in entering the market.

Taking a loan amount of 4 million, a term of 25 years, and H+1.3% as an example, the current actual interest rate is 1.397%, and the monthly payment is 15,805 yuan, compared with the 2.5% cap interest rate of H in April last year The rate of 17,945 yuan, a year later, the monthly payment will be significantly reduced by 2,140 yuan, a drop of 11.9%. The monthly interest expense also saves 3,676 yuan (-44.1%).

Continued advantage H accounts for 95.9%

Since the interest rate differential between H and P has widened to more than 1%, the advantage of H has continued to be maintained. According to the latest statistics from the HKMA in February, H according to the selection ratio increased by 0.4 percentage points to 95.9% on a monthly basis, and 17 The historical record was tied after July 1st. At present, bank buildings are positive and positive. In the first quarter of this year, the mortgage discounts offered by banks have increased, making H continue to increase in attractiveness. It is expected that the proportion of H selection will further rise to a historical high.

Like