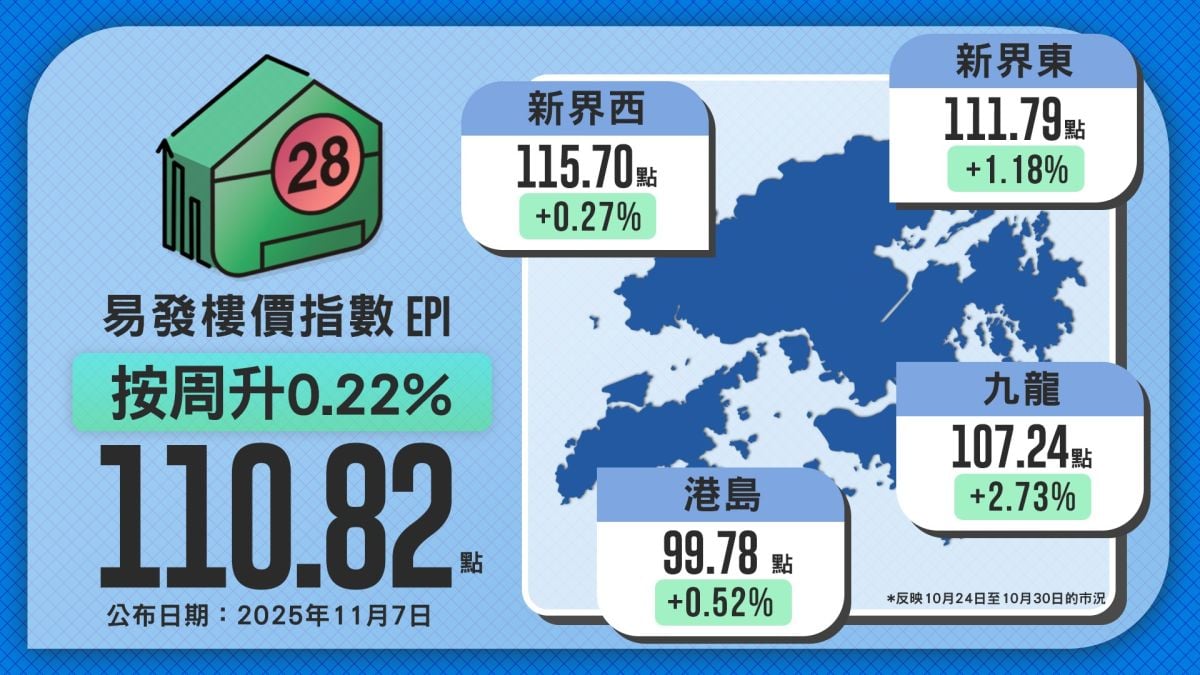

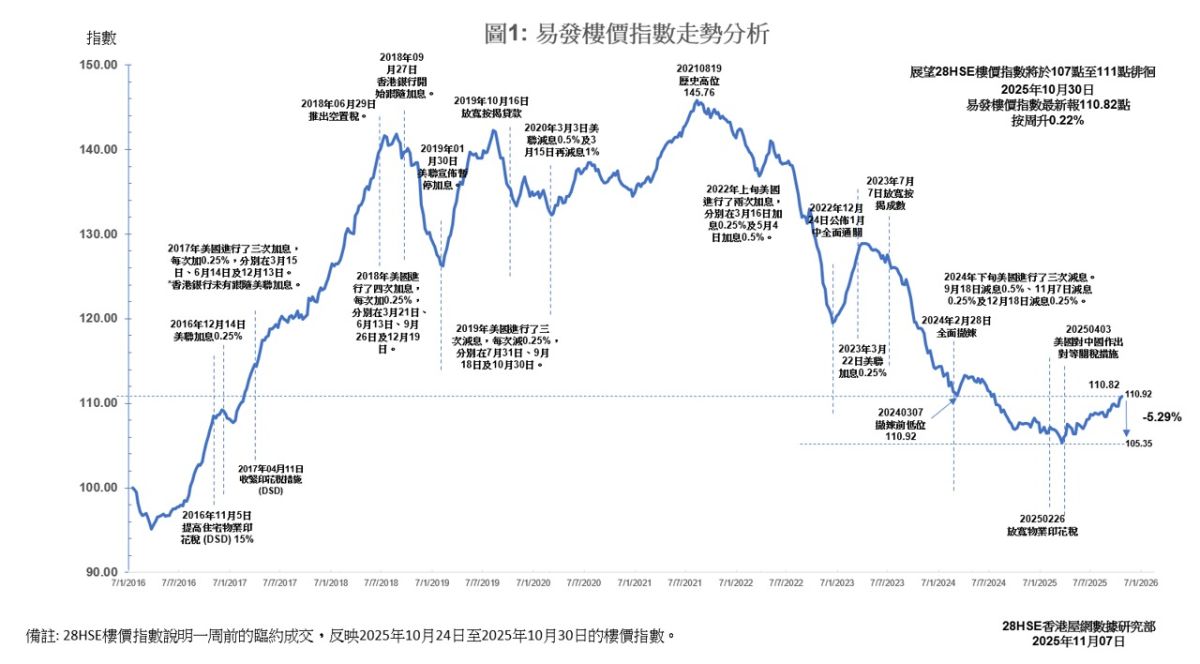

Hong Kong’s housing market sentiment continues to improve, with the latest weekly Eva Property Index (EPI) rising to 110.82 points, up 0.22% week-on-week. This marks the first time since the removal of property cooling measures that the index has remained above the 110-point threshold for two consecutive weeks, edging closer to the pre-policy low of 110.92 points. Year-to-date, the index has gained 3.63%, though it remains approximately 23.97% below the 2021 peak of 145.76 points.

Analysts attribute the recent price stabilization to the U.S. Federal Reserve’s 25-basis-point rate cut, which prompted local banks to lower their prime mortgage rates. The resulting decline in home financing costs has encouraged some renters to transition into homeownership. Additionally, improving Sino-U.S. relations has further boosted market sentiment and supported transaction activity.

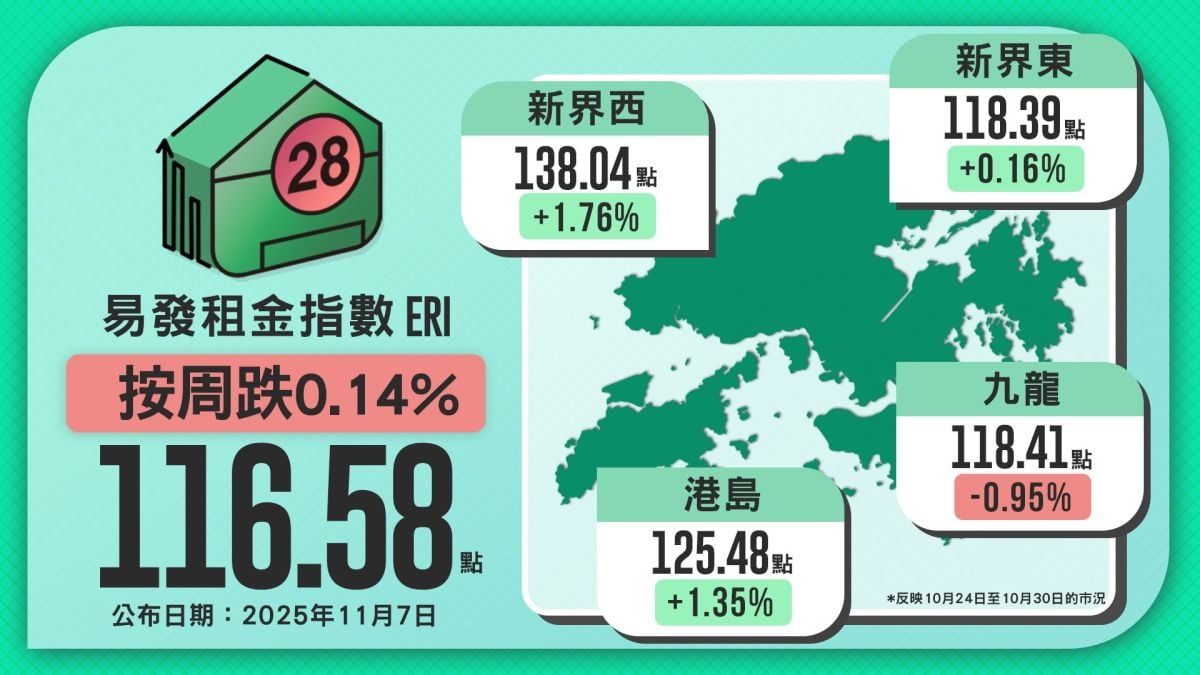

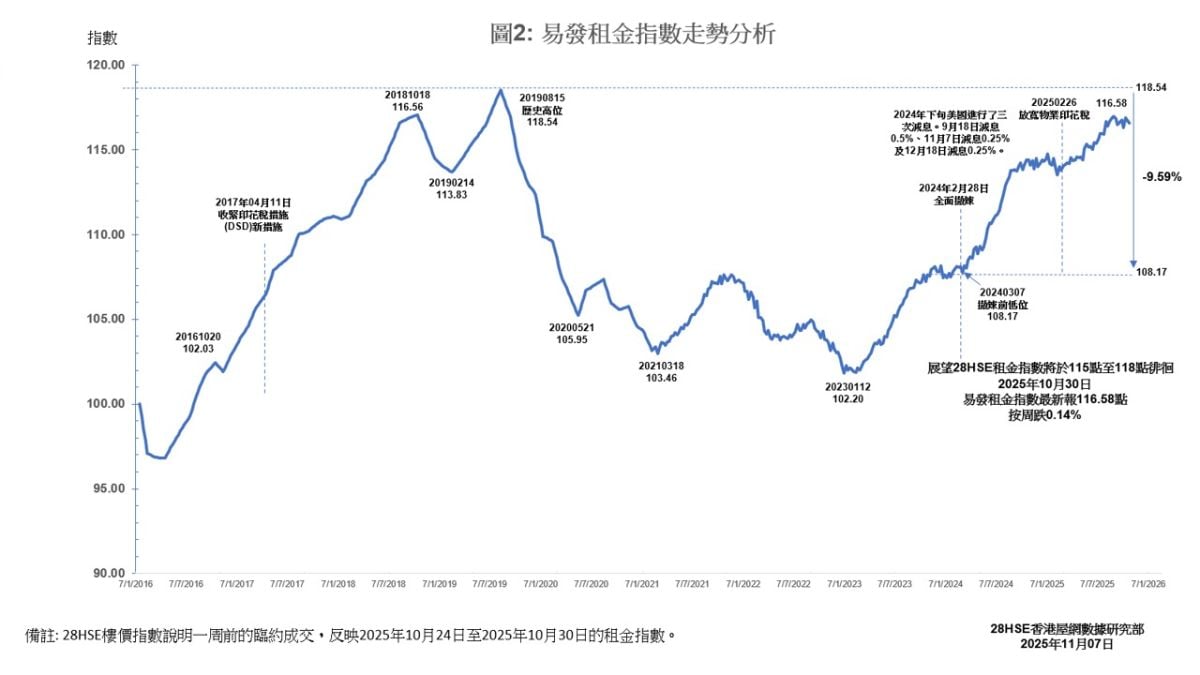

Meanwhile, the latest Eva Rental Index (ERI) edged down 0.14% to 116.58 points, though it has held above the 116-point level for thirteen consecutive weeks. With three of the four major regions recording gains and only one showing a decline, the data reflects strong underlying end-user demand for housing. In the near term, the rental index is expected to remain range-bound between 115 and 118 points.

All Districts Record Price Gains

Hong Kong’s residential property market saw broad-based gains in district-level home price indices this week, reflecting a continued recovery in sentiment. Over the weekend (October 26–27, 2025), secondary market activity was notably active. According to data from four major property agencies, weekend transactions across the ten benchmark housing estates increased across the board. Centaline Property and Midland Holdings each recorded 18 to 19 deals, representing a week-on-week increase of approximately seven transactions.

While there is limited momentum for sharp price increases in the short term, the overall market atmosphere has clearly improved compared to earlier this year, with transaction volumes providing support. As a result, home prices are expected to remain stable in the near term.

Among the districts, Kowloon posted the strongest performance, with its index rising 2.73% week-on-week to 107.24 points, driven by sales in new developments such as the Pavilia Forest, Cullinan Sky, and Victoria Voyage in Kai Tak. New Territories East climbed 1.18% to 111.79 points, marking its third consecutive weekly gain. Hong Kong Island rose 0.52% to 99.78 points, while New Territories West edged up 0.27% to 115.70 points.

In New Territories East, unsold inventory from primary projects continued to decline. During the third quarter, the number of unsold units fell by over 800 to between 4,100 and 4,200 units. Tseung Kwan O saw the most significant drop, with inventory falling from 1,968 units to 1,088 units—a reduction of 880 units—highlighting strong market absorption. On Hong Kong Island, woodis successfully sold out 30 units, further improving sentiment and supporting steady price growth.

Looking ahead, market consensus suggests that the pressure from high interest rates is gradually easing. The U.S. Federal Reserve has implemented two consecutive 25-basis-point rate cuts, and the one-month Hong Kong Interbank Offered Rate (HIBOR) has subsequently declined. This is expected to reduce mortgage and financing costs, encouraging both individual buyers and corporate investors to enter the market. Additionally, recent signs of easing tensions in Sino-U.S. relations have boosted investor confidence. The home price index is projected to trend toward 111 points, potentially surpassing the pre-policy low.

Rental Index Dips 0.14%, Remains Elevated

Meanwhile, the rental market showed mild softness. The Eva Rental Index slipped 0.14% to 116.58 points but has remained above 116 points for thirteen consecutive weeks, indicating continued strength. Although the summer leasing peak has passed, rental levels remain near annual highs. The Hong Kong government’s recent relaxation of quotas for non-local students at tertiary institutions is expected to support leasing demand, keeping the rental index within a narrow range of 115 to 118 points in the short term.

Mixed Performance Across Districts

District-level rental indices showed a mixed pattern, with three districts recording gains and one declining. New Territories West posted the largest increase, rising 1.76% to 138.04 points, marking its third consecutive weekly gain. Hong Kong Island rose 1.35% to 125.48 points, also up for three weeks in a row. New Territories East edged up 0.16% to 118.39 points. In contrast, Kowloon fell 0.95% to 118.41 points.

These figures reflect market conditions from October 24 to October 30, 2025.

Like