The interest rate hike is imminent, the economic outlook is uncertain, the low-price promotion for developers is difficult to work

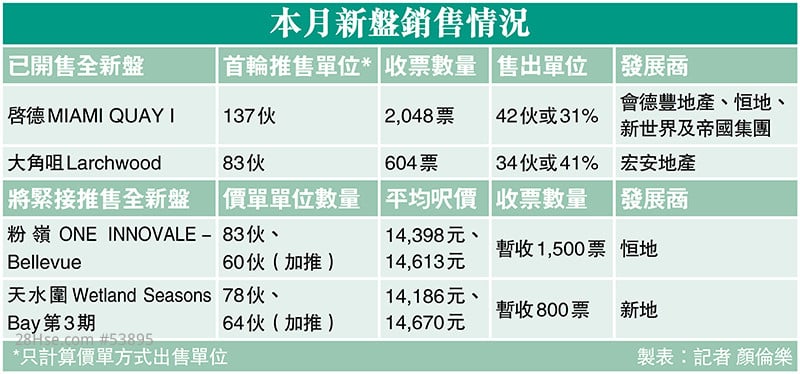

The U.S. will discuss interest rates this Wednesday, and the market is expected to continue to raise interest rates by 0.75%. The industry expects that the banks in Hong Kong will follow the interest rate hike this time. dismal. The two brand-new projects, Kai Tak MIAMI QUAY I and Tai Kok Tsui Larchwood, which were launched in September, only sold 30% to 40% of the units in the first round of sales. The former sold 139 units in the second round yesterday, and only 2 units were sold, with a sales rate of 1.4%. Industry insiders pointed out that the current interest rate hike has just begun, coupled with the deterioration of the global economy, Hong Kong will inevitably be impacted, and the negative impact on the Hong Kong property market is expected to continue at least until the end of the year. New projects may continue to increase discounts or directly reduce prices.

◆reporter Yan Lunle

The new project MIAMI QUAY I in Kai Tak Runway District, jointly developed by Wheelock, Henderson Land, New World and Empire Group, had its second round of sales yesterday, including 139 units sold on a first-come, first-served basis with price list and 1 launched by tender. A 4-bedroom characteristic household. The developer said that 2 units were finally sold. The conversion accounted for 1.4% of the second round of sales units. On Saturday and Sunday, there were only 7 transactions in the new market, and second-hand transactions in the top ten housing estates were also in single digits. The transaction in the property market can be said to be extremely sparse.

185 units are temporarily sold this month

In fact, the lack of sales of this round of new disks has already been traced. MIAMI QUAY I launched its first round of 137 units earlier this month, and only 42 units were sold today, accounting for only about 30% of the price list. Larchwood, Wang On, Tai Kok Tsui, launched its first round of sales in early September with 83 units, which were sold in a single day. About 34 units, accounting for more than 40% of the units available for sale in the first round. It is now mid-to-late September, and only 185 units have been sold in the primary market. In contrast, 2,042 units were sold in August.

A large number of tails are for sale, and it is difficult to split the price temporarily

Zhang Qiaochu, managing director of Hongliang Consulting and Evaluation, said that the market expects a large rate hike in the United States this week, and the market outlook is not clear, both stocks and properties are affected. Under the energy crisis, the market is worried that the global economy will deteriorate further, and Hong Kong will inevitably be affected. Under such circumstances, the sales of buildings in Hong Kong will inevitably slow down, and developers will be more conservative in asking prices. However, he believes that the first-hand price break has not yet been reached, because the developer still has a large amount of goods for sale. If the price is broken, it will suffer a greater loss, and the developer will also weigh the risk. Since the rate hike in Hong Kong has just begun, the negative impact on the property market in Hong Kong is expected to continue at least until the end of the year.

Zhang Shengdian, a visiting associate professor at the Department of Real Estate and Construction at the University of Hong Kong, said that the market situation is uncertain, and prospective buyers have recently become wait-and-see, resulting in a slowdown in sales. He expects that in order to attract market purchasing power, developers will continue to increase discounts or directly reduce prices.

In fact, since the U.S. continued to raise interest rates sharply, prospective buyers have tended to wait and see. Among them, Tuen Mun NOVO LAND and Fanling ONE INNOVALE are "in command" at low prices. In August, they were launched at lower second-hand prices in the same area, with an average price of about 13,000 to 14,000 yuan per square foot. Driven by the sales of the two properties, the property market once showed a "booming trend". In August, the first-hand transaction volume recorded over 2,000, a sharp increase of 1.2 times month-on-month.

However, the momentum of the low-price promotion was short-lived. Entering September, as the external economy has not improved, and there is no sign of customs clearance in Hong Kong, the sales of new listings have fallen into a bottleneck. For this reason, many developers have used different methods to attract buyers, especially in the late stage of existing properties. In the past, when the property market was on the rise, the price of existing properties should have risen compared with the stage of uncompleted properties. However, recently, many developers have When selling an existing property, discounts are added in disguised form to reduce prices, extend the transaction period and provide financial loans, etc. There are endless tricks.

After trying all the tricks, the sales still have no improvement

For example, Ho Man Tin Fong Fei, a subsidiary of Hip Shing Hong, handed over the building in September and entered the existing building stage. However, when the newly launched unit was launched at the end of August, although the price was the same as when it was first launched in July last year, the discount rate increased from 10% last year to 15%. %, the change is equivalent to a price reduction, and the new payment method also provides a one-click, and helps buyers to change flats, etc. However, the sales of this property are still deserted. In September, 11 units were sold on a first-come, first-served basis, and only 2 units were sold in the end.

As for the first phase of Jinhuan on the southern shore of Hong Kong Island at Wong Chuk Hang Station, which is expected to be completed by the end of this year, a series of discounts have also been offered when 80 more units have been launched recently. It was 18% when the price was first advertised in April last year, but the open-plan unit was further discounted by 3.7% to 21.7%, obviously trying to boost the sales of open-plan units. The developers' performance of various launches reflects the weak purchasing power of the market, and it is necessary to increase the incentives to attract prospective buyers.

It is worth noting that there are still two new disks ready for sale this month, and their sales will be directly affected by changes in interest rates. Among them, Henderson Land Fanling ONE INNOVALE - Bellevue recently announced the first price list, offering 83 units at a discounted average square foot price of HK$14,398; SHKP Tin Shui Wai Wetland Seasons Bay Phase 3 also announced its first price list a few days ago, offering 78 units at a discount The average price per square foot is 14,186 yuan. Recently, 60 units and 64 units have been added for the two projects respectively, and the average price per square foot is about 14,613 yuan and 14,670 yuan, and the prices are relatively restrained.

Like 39