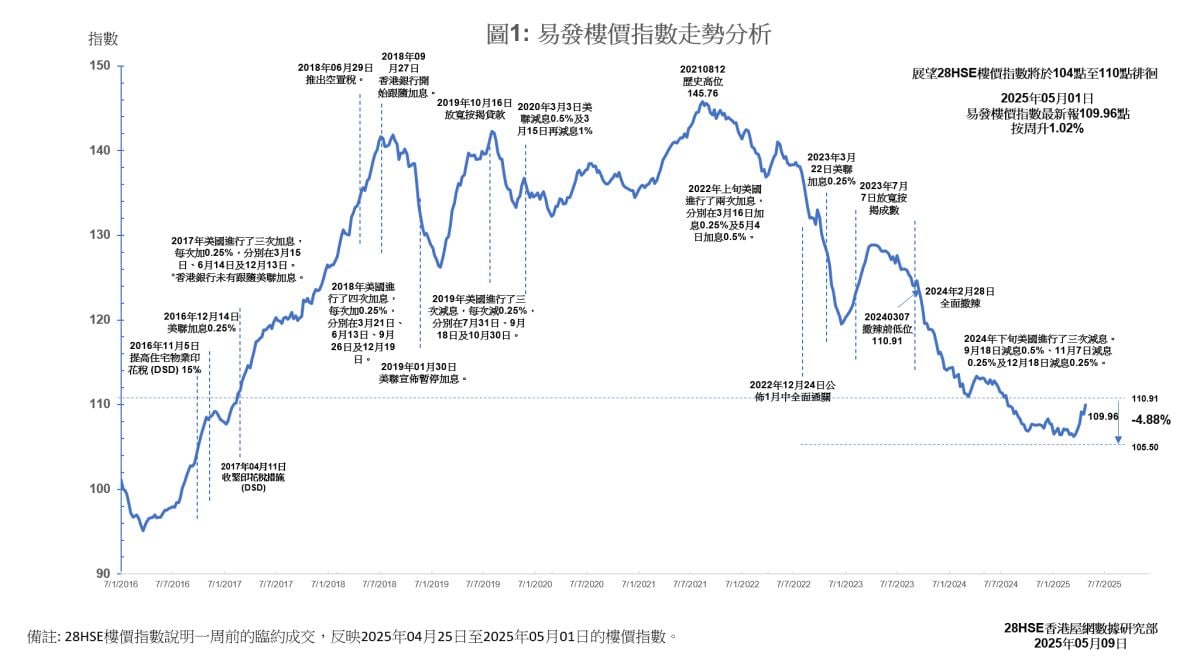

With the United States gradually softening its stance on the tariff war and market expectations of lower interest rates, buyer confidence in the property market is steadily recovering. The latest Eva Property Price Index is reported at 109.96 points, up 1.02% from the previous week, marking a new high for the first half of this year. This indicates signs of property prices stabilizing.

Following the discounted launch of the new residential project "Sierra Sea" in Sai Sha, all three initial rounds of sales were sold out on the same day, showcasing strong performance and becoming a notable sign of market recovery. The project also injected positive momentum into both the primary and secondary markets, further revitalizing market sentiment.

According to real estate agency statistics, the number of property viewings over the weekend saw a significant increase, ending a three-week decline. The number of viewing appointments in the top ten housing estates reached 327 groups, a 3.5% increase from last week’s 316 groups. This data indicates that market confidence is gradually recovering, with many prospective buyers speeding up their search for preferred units amid expectations of lower interest rates, leading to a noticeable growth in property viewings.

However, market pressure remains significant. The primary residential market currently faces the challenge of supply backlog. According to real estate agency data, the number of unsold new private residential units has exceeded 20,000, which may divert significant demand from the secondary market. The oversupply issue is difficult to resolve in the short term, posing continued pressure on the property market trend. Although the recent rebound in the price index is evident, experts generally believe that the overall market has not yet escaped a downward trend, with the price index expected to further test the 108-point level this quarter. Market observers are urged to maintain a cautious outlook for future developments.

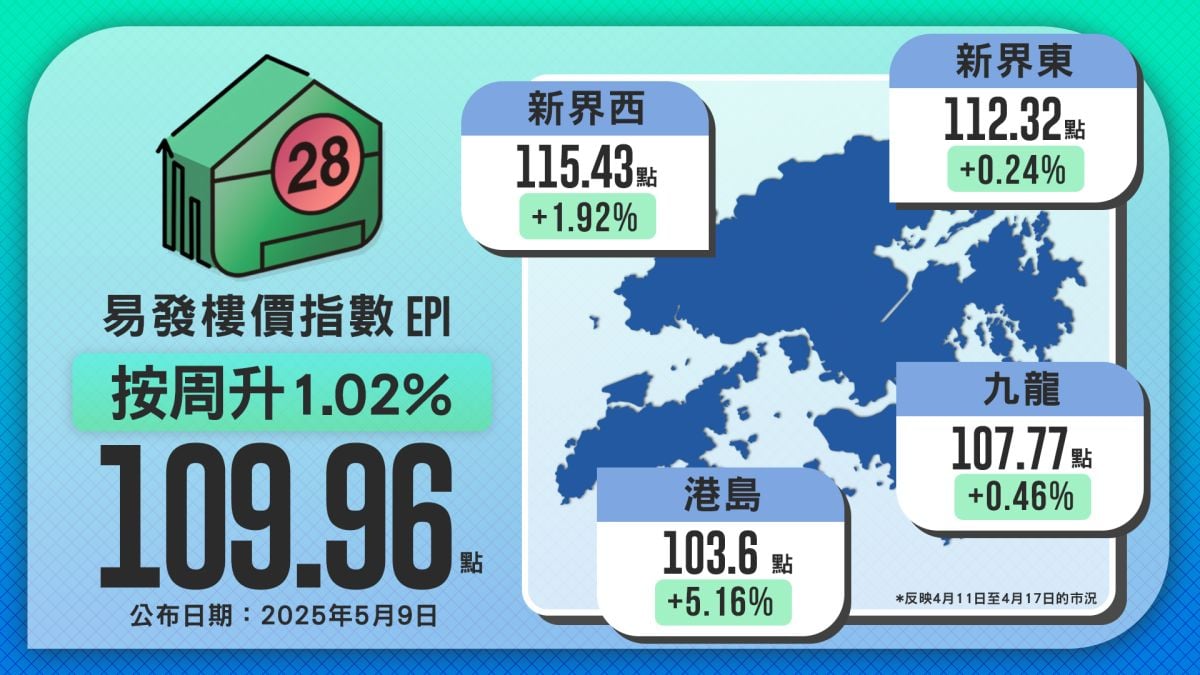

Price Index Up Across All Four Districts Hong Kong District Rises by 5.16%

The property price index in all four districts has risen this week, indicating a continuous warming of market sentiment. Among them, the Hong Kong district showed the most robust growth, with the latest index reaching 103.6 points, up 5.16% from the previous week, setting a new high for the year and emerging as the best-performing area this week.

New Territories West followed closely, with the latest index at 115.43 points, up 1.92% from the previous week, marking the third consecutive week of increases, indicating steadily growing demand in the area.

In Kowloon, the latest index stands at 107.77 points, up 0.46% from the previous week, successfully reversing last week’s decline. New Territories East remained relatively stable, with the latest index reported at 112.32 points, up 0.24% from the previous week.

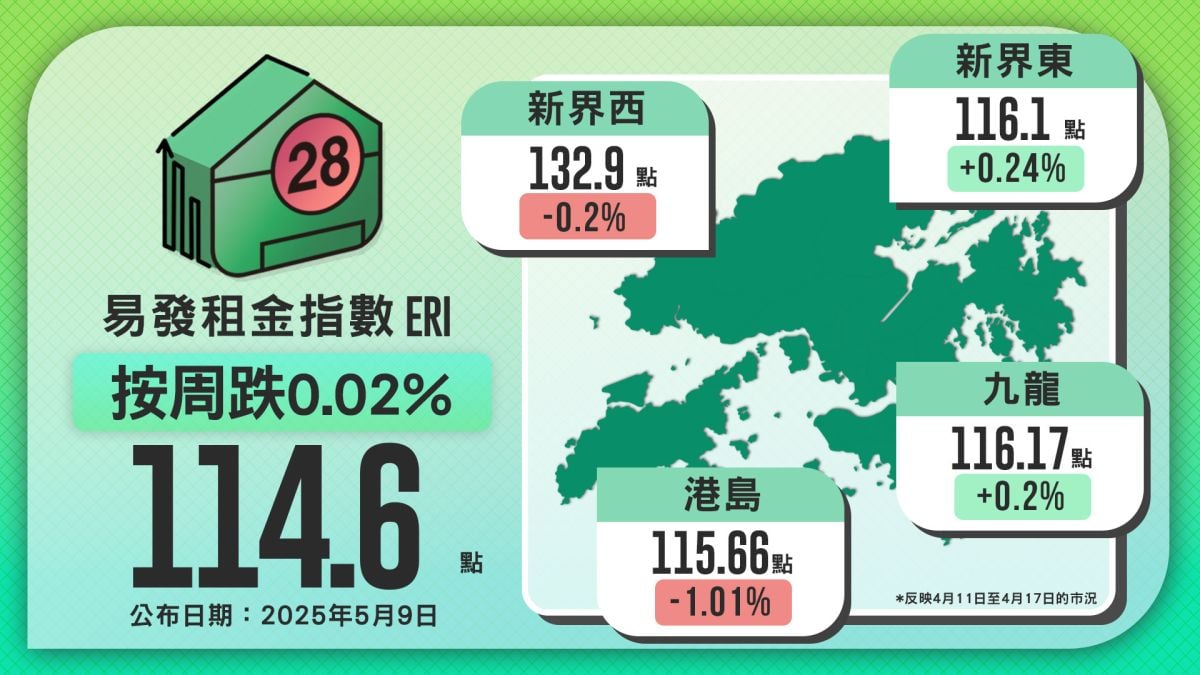

Eva Rental Index Moves Narrowly Stays Around 114 Points, Slightly Down by 0.02%

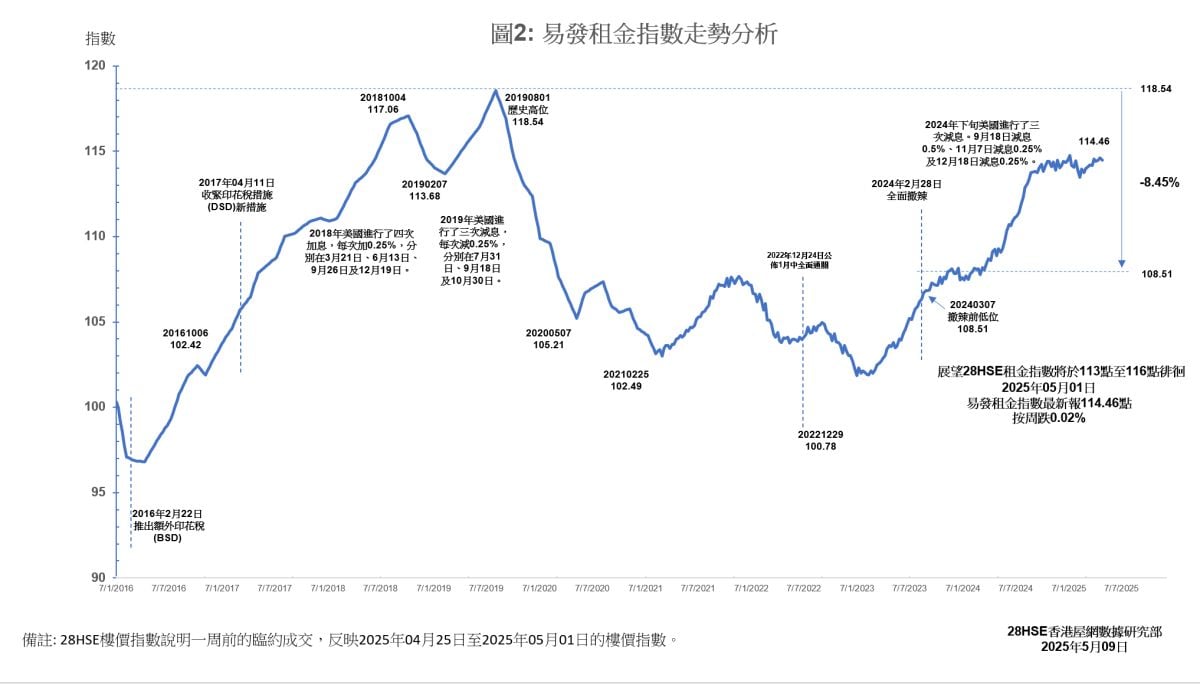

The latest Eva Rental Index recorded 114.46 points, down 0.02% from the previous week, indicating that the rental market remains relatively stable. Although the overall change in rent is minimal, the anticipation of lower interest rates is prompting some tenants to shift from renting to buying, further altering the demand structure in the rental market.

In terms of regional indices, the four districts showed a mixed performance of "two rises and two falls," reflecting a divergence in the rental market performance across different areas.

The Hong Kong district experienced the largest drop, with the latest index at 115.66 points, down 1.01% from the previous week, indicating weakened rental demand. New Territories West also saw a slight decline, with the latest index at 132.9 points, down 0.02% from the previous week.

On the other hand, Kowloon and New Territories East recorded increases, indicating steady rental demand in certain regions. The latest index in Kowloon was 116.17 points, up 0.2% from the previous week, while New Territories East rose slightly to 116.1 points, up 0.24% from the previous week.

This week's index reflects market conditions from April 25 to May 01, 2025.

Like