Property prices fall, bank valuation gap is huge, owners need to raise money "Shanghui"

The property market is sounding a new alarm! According to the statistics of Centaline Property, from 2020 to the third quarter of 2022, the number of new projects completed by the finance company has reached 2,458, involving a total capital of 23.638 billion yuan. Buyers who owe a little are "borrowed" for the purpose of getting on the car. These wealthy boys generally have a "low-interest honeymoon period" of two or three years, and then they will receive a high interest rate of P+2% or even P+3%. The small owners who have been mortgaged will then transfer the unit to the bank. The problem is that new properties in two or three years are generally sold at a high premium, and now property prices have fallen by 10-20%, and people have switched to raising money on demand. Edition Press "Crisis. ◆reporter Zeng Yejun

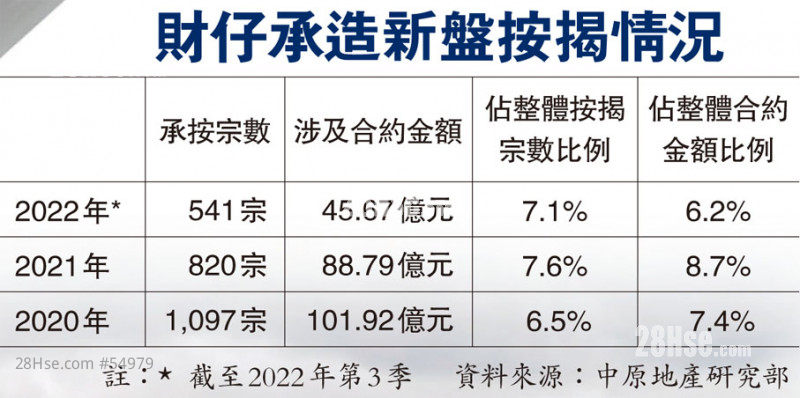

According to the statistics of Centaline Research, as of the third quarter of this year, 541 new projects completed in 2022 were pledged by finance companies, involving a sales and purchase contract value of 4.567 billion yuan, accounting for 7.1% and 6.2% respectively, down 0.6 and 0.4 quarter-to-quarter. percent. 820 new projects completed in 2021 were pledged by finance companies, involving a sale and purchase contract value of 8.879 billion yuan, accounting for 7.6% and 8.7% respectively, up 0.2 and 0.4 percentage points quarter-to-quarter. Of the new projects completed in 2020, 1,097 were pledged by finance companies, involving sales and purchase contracts of MOP 10.192 billion, accounting for 6.5% and 7.4% respectively, up 0.1 and 0.3 percentage points quarter-to-quarter.

Difficult to sell according to buyers

In other words, from 2020 to the third quarter of this year, a total of 2,458 new projects have been mortgaged by finance companies, involving a total capital of 23.638 billion yuan. According to the mortgage industry, the characteristics of Caizai mortgage are generally two or three years of "ultra-low interest honeymoon period" at the beginning. The high interest rate of +2% or even P+3%, so many new projects will cooperate with financial companies to provide financial mortgages, and use the "ultra-low interest honeymoon period" in the first two or three years to attract buyers who are less able to get on the car. Buyers are looking forward to adding labor or rising property prices in two or three years, and they can easily transfer the unit to the bank to avoid the high interest rate butcher knife of Caizi.

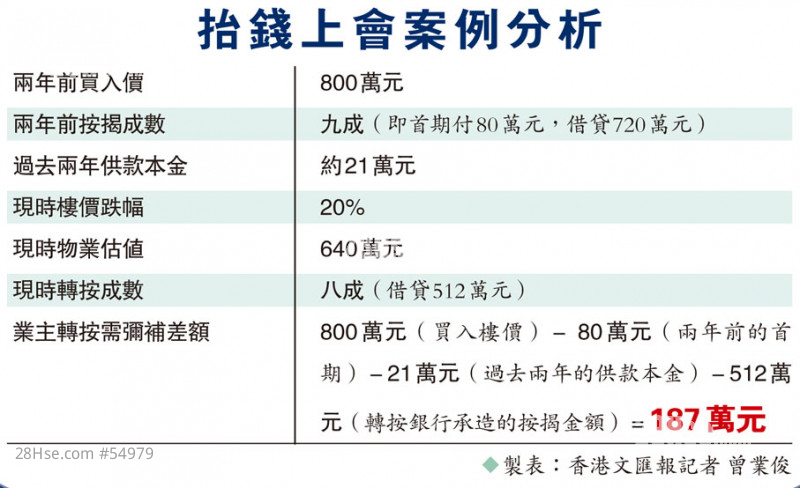

However, people's calculations are not as good as heaven's calculations. In the past two or three years, the property market was at its peak, and new properties were sold at high premiums. Currently, the mortgage is transferred to the bank. With the property price falling and the interest rate rising, the property price calculated by the bank's mortgage is the same as that of the small owner on that day. There is at least a difference of several hundred thousand yuan or even more than one million yuan, which needs to be made up by the small owners who need to remortgage. The buyer who borrowed the money from Caizai has already become "mummy", and now he has to pay millions of dollars in cash to make up the price difference. It is foreseeable that the situation is extremely pessimistic.

Or create a "black swan" event at any time

Caizi is not regulated by the HKMA, and no one knows their financial status, which is even more worrying. The funds for Caizi also come from the banking system.A large number of high-account customers have an accident and may be dragged down or even bankrupt, and in serious cases, it will affect the banking system. These Caizai Press may have become a high-risk group. At the same time, due to the large number of customers of Caizai Press, many social problems may also arise from this. The government should take precautions and respond to this as soon as possible to prevent the occurrence of "black swans". It even evolved into a "Hong Kong version press" crisis.

Whether or not to "explode" depends on two factors

Zhang Shengdian, visiting associate professor of the Department of Real Estate and Construction of the University of Hong Kong, believes that between 2020 and 2022, about 150,000 properties have been transacted, and the proportion of 2,458 Caizai mortgages is not high. In addition, the primary mortgage is well controlled, but the ultimate contributors Whether it will "explode" still depends on the extent of the downturn in the property market in the future. He believes that since the financial turmoil and the financial tsunami, the HKMA has managed the mortgage risk very well, and the borrowers' income and asset checks have been done well, and the ability to resist the downturn in the property market is stronger than before. The chances of falling on the cliff are not high, but in the end, the economy still needs to return to normal, the society needs to regain its upward momentum, and the government needs to make efforts in this regard.

Chow Guangrong, chair professor of the Department of Real Estate and Construction of the University of Hong Kong, believes that whether the mortgage of Caizi will "explode" on a large scale and shake Hong Kong's financial stability depends on the employment situation in Hong Kong. If the situation is stable, I believe there will be no problem.

Like 1