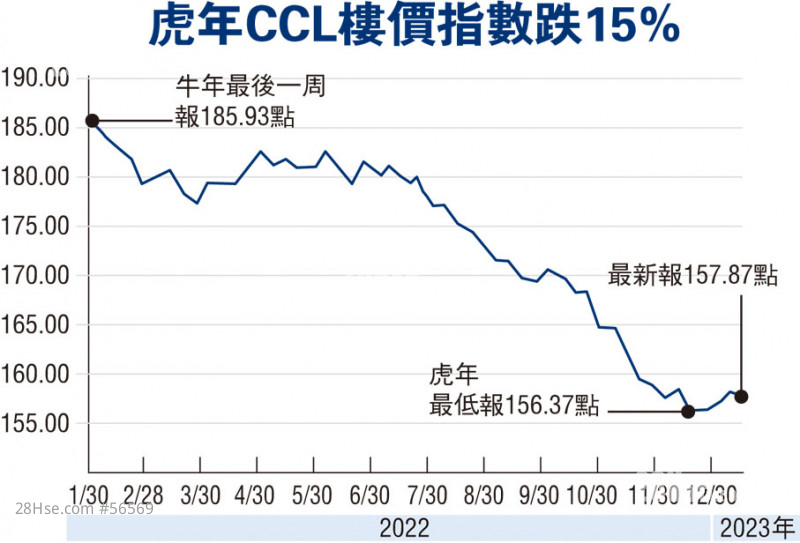

Facing the impact of the epidemic, the property market fell by more than 15% in the Year of the Tiger, significantly underperforming the stock market. Centaline CCL, which reflects the performance of the overall second-hand property prices in Hong Kong, was last quoted at 157.87 points. Compared with 185.93 points in the last week of the Year of the Ox, the year of the Tiger has fallen by 15.09% for the whole year. According to previous figures, property prices fluctuate greatly in the year of the tiger, while the trend of property prices in the year of the rabbit is relatively stable. In 1998, in the Year of the Tiger, CCL fell by 20.98%, and in 2010, in the Year of the Tiger, CCL rose by 18.47%. In 1999, the Year of the Rabbit CCL dropped slightly by 3.32%, and in 2011, the CCL rose by 4.32%. Zhong Yuan pointed out that the Year of the Rabbit is approaching, and it is hoped that property prices will resume their upward trajectory after the adjustment.

CCL rebounded nearly 4 weeks after bottoming out

Huang Liangsheng, Senior Co-Director of Centaline Real Estate Research Department, pointed out that CCL was last at 157.87 points, a slight drop of 0.23% on a weekly basis. After rising for 3 consecutive weeks, property prices softened in a single week, and the trend continued to rise repeatedly. In the past 4 weeks since CCL bottomed out (156.37 points), it has risen by 0.96%. This week's index reflects that second-hand transactions have begun to boom after the Christmas holiday, and property prices are accumulating strength to break through and rise. Looking forward to the smooth arrival of the seasonally prosperous market after the Spring Festival, CCL will return to the 160-point level, and the current difference is only 2.13 points or 1.33%.

The leading index of large housing estates, CCL Mass, reported 158.14 points, down 0.13% on a weekly basis. CCL (small and medium-sized units) closed at 156.47 points, down 0.07% on a weekly basis. CCL Mass and CCL (small and medium-sized units) also rose slightly for 3 weeks and then softened slightly. CCL (Large Units) closed at 164.84 points, down 0.92% on a weekly basis. In the past four weeks since property prices bottomed out, CCL Mass has risen 1.48%, CCL (small and medium units) has risen 1.37%, and CCL (large units) has fallen 0.77%.

Property prices on Hong Kong Island rose by 3.69%

In the four districts, the property price index on Hong Kong Island reported 161.34 points, up 1.5% week-on-week, and rose 3.69% for 4 consecutive weeks. The New Territories West property price index closed at 147.28 points, up 0.62% week-on-week, and rose 1.6% for 2 consecutive weeks. The Kowloon property price index closed at 151.6 points, down 1.26% week-on-week, ending a three-week winning streak. The New Territories East property price index reported at 168.20 points, down 1.31% week-on-week, falling 1.88% for 2 consecutive weeks. Nearly 4 weeks after property prices bottomed out, Hong Kong Island rose 3.69%, Kowloon rose 1.17%, New Territories East rose 0.21%, and New Territories West rose 0.5%.

Another agency, Midland Realty, said that both first-hand private housing and second-hand housing transactions fell sharply year-on-year. According to data from the Integrated Land Registry of Midland Real Estate Data and Research Center, based on the lunar calendar year, excluding first-hand public housing, the number of first-hand private housing and second-hand residential registrations totaled 45,302, compared with the previous year. The year of the ox recorded 74,707 cases, a decrease of about 40% year-on-year.All-year low.

The economy returns to normal and the atmosphere of the property market picks up

Liu Jiahui, chief analyst of Midland Realty, pointed out that with the quarantine-free customs clearance in the Mainland and Hong Kong, Hong Kong's economy has gradually returned to normal, and the atmosphere in the property market has picked up recently. In terms of second-hand, based on the data of Midland Branch, the average weekly transaction volume of 35 large-scale housing estates in Hong Kong in the last four weeks of the Lunar New Year is compared with the average weekly transaction volume of the whole year (in Lunar Year). In the last 4 weeks of the year, the transaction volume of 35 housing estates recorded an average of about 105 transactions per week, which was about 54% higher than the average weekly transaction volume of about 68 transactions for the whole year (calculated in the lunar calendar year), which was the best performance in the past 16 years. Liu Jiahui believes that he believes that following the momentum of the "tiger tail", the upcoming Year of the Rabbit will have a good start. He believes that the property market will show a new look in the new year, and both first-hand and second-hand transactions have rebounded significantly compared to the Year of the Tiger.

Like 18