The URA’s To Kwa Wan Bailey Street/Wing Kwong Street development project closed the tender yesterday afternoon, but the market’s response was weaker than expected. Only 6 tenders were received, the URA with the worst bidding response in more than 6 years. project. The surveyor estimated that the project mall must be held for at least 10 years and cannot be sold, and the frontage to Ma Tau Wai Road is extremely small, causing developers to hesitate. reporter Yan Lunle

For the To Kwa Wan project, 33 interested developers were invited to enter the bid earlier this time. By the close of the bid yesterday, the bureau announced that it had received 6 bids. Looking at the information, the response to this tender was the worst response in more than 6 years after receiving two bids from 229A to G Hai Tan Street, Sham Shui Po at the end of 2014. Compared with the largest-scale Kwun Tong Grand Plaza in the history of the URA launched in August 2014, it received 6 bids at that time.

Market conditions are inferior to developers

Leung Peihong, senior director of Huafang Consulting and Evaluation, said that the tender response this time was not as expected. It is believed that because the project mall must be held by the winning bidder for at least 10 years and cannot be sold, some developers are deterred. In addition, the frontage of the site towards Ma Tau Wai Road is extremely small, and the commercial part of the project can only be prospered by the successful operation of the remaining URA "Community Development" shopping malls. The location is extremely passive, which also makes many developers less interested in bidding. .

Based on market information, K. Wah, Cheung Kong, SHKP, and Henderson acquired the bid for the bidding consortium yesterday. The joint venture includes a combination of Chinachem and Wheelock Properties, as well as a combination of Sino Land, Kerry and China Merchants Land. K. Wah Hong Kong Real Estate Development and Leasing Director Yin Ziwei pointed out yesterday that the project has a large area and is close to a subway station. It is believed that it has development potential and is expected to develop small and medium-sized units.

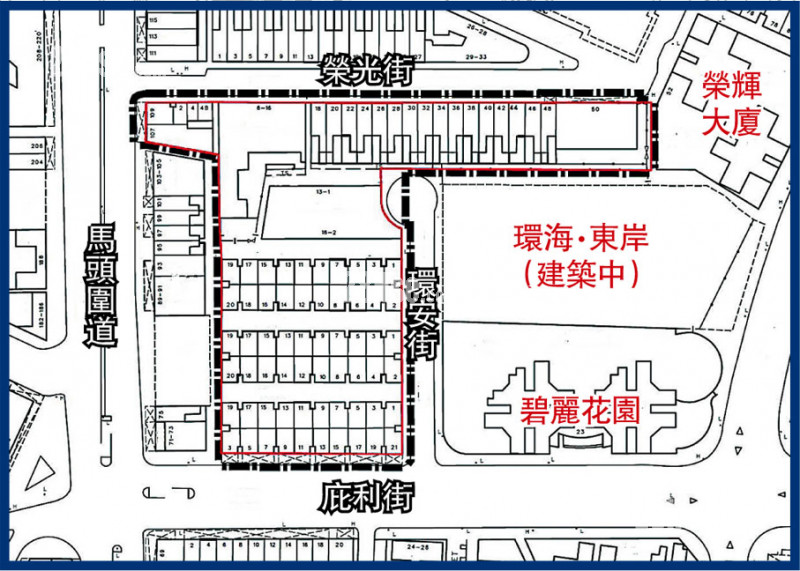

Over 710,000 square feet of floor space, valued at 10.7 billion

According to the data, the To Kwa Wan Bailey Street/Wing Kwong Street development project is adjacent to the "East Coast". It is the largest residential site after the URA's 2014 tender for the Kwun Tong downtown redevelopment project, with a total floor area of 717,464 square feet, of which 11.95 Ten thousand square feet is a commercial floor, providing about 1,150 units, and an underground public parking lot needs to be built. The market valued the project from 7.9 billion yuan to 10.762 billion yuan, and the estimated land price per square foot was 11,000 yuan to 15,000 yuan.

According to the bidding terms reported in the market, the area of each unit must not be less than 300 square feet, and half of the area must be between 300 and 480 square feet. In the first 10 years, the shopping mall is jointly held by the developer and the URA. The rental income developer accounts for 70% and the URA accounts for 30%. Later, you can choose to sell each other’s rights to each other, or choose to extend the joint ownership of the project for 5 years. After 15 years, the mall will open tenders again, and continue to distribute dividends with a score of 73. The public parking lot of the project can be sold by tender at any time.

In the future, the project will have to pay a dividend of 14.8 billion yuan from the sale of buildings, which is the URA project with the highest dividend limit. After reaching the standard, the first 250 million yuan will be dividends 20%.Proportionally increase up to 50%. Calculated on the basis of a residential floor area of about 598,000 square feet, that is, if you sell more than 24,700 yuan per square foot, you will have to pay dividends.

Like