CCL is less than 4% from the top of the roof, surveyors call for drastic pushes on public housing

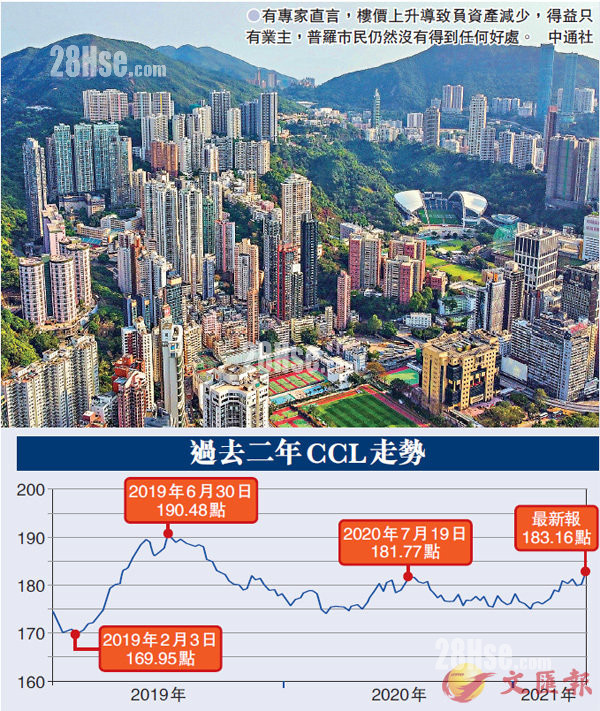

The property prices in Hong Kong began to rebound rapidly at the beginning of this year, and they were close to the impact of the restoration of the new crown epidemic. After two years of suppressed housing demand, the public's demand for home ownership broke out to a frenzied level. Prospective buyers without fathers continued to look forward to the property and sigh. The Central Plains City Leading Index CCL, which reflects second-hand property prices, was last reported at 183.16 points, up 1.65% on a weekly basis, the largest increase in 162 weeks, breaking through last year's high (181.77 points), and only 3.84 from the historical high of 190.48 points in June 2019 %. Some surveyors believe that the increase in property prices is reflecting the plight of the public, and the burden of mortgage and renting is likely to increase. They call on the government to re-examine the land sales surface and use drastic measures to increase public housing. reporter Li Zitian

Zhang Qiaochu, managing director of Hongliang Consulting and Appraisal, believes that the serious problems caused by rising property prices are the focus of social attention. He pointed out that rising property prices have led to a decrease in negative equity. Only the owners benefited, and the general public still did not get any benefits. Due to income and other issues, not all grassroots citizens can benefit from subsidized housing. In the future, rents will also rise due to property prices, and the burden on the public will become heavier and heavier.

Commercial land to build subsidized buildings to meet urgent needs

Therefore, he suggested that the government should re-examine the land sales table and put some land that is not in luxury residential areas or commercial land, be cruel, and allocate all of it to the construction of subsidized housing to solve the urgent needs of the public.

Huang Liangsheng, senior co-director of Centaline's research department, pointed out that buyers actively entered the market during the Easter holiday, which stimulated the expansion of property prices across the board. CCL's latest report was 183.16 points, up 1.65% on a weekly basis, the largest increase in 162 weeks, with a total of 1.78% in two consecutive weeks, pushing CCL to rise above last year's high (181.77 points in July), setting a new high in nearly 20 months (i.e. 2019) New highs after September 2008), the market conditions in the first week after the resurrection holiday. He believes that in the future, the CCL's upper and lower volatility will expand, and the trend will continue to rise, approaching the historical high of 190.48 points in June 2019, which is only 3.84% behind.

According to the bank, CCL (small and medium-sized units) reported 183.20 points, a weekly increase of 1.44%, the largest increase in 76 weeks, and a total of 1.71% for two consecutive weeks. The leading index of large housing estates, CCL Mass, reported 185.47 points, up 1.36% on a week-to-week basis, and a total of 1.85% for two consecutive weeks. CCL (large unit) reported 182.98 points, up 2.77% weekly, the largest increase in 16 weeks. CCL (small and medium-sized units) hit an 84-week high, while CCL Mass and CCL (large-scale units) both hit an 85-week high, which are respectively 3.68%, 3.23%, and 4.66% from their historical highs.

Large units chased behind in the past 8 weeks

In the past 8 weeks, the four major indexes have moved up repeatedly. CCL, CCL (small and medium-sized units) and CCL Mass have the same trend, 5Zhou Qisheng, 3 weeks, all fell, increasing 3.38%, 3.00% and 2.84% respectively. CCL (large units) recorded 4 ups and 4 downs, with a cumulative increase of 5.38%, catching up with the previous lagging gains.

The volatility of property prices in the four districts also expanded. The Hong Kong Island property price index reported 191.63 points, a 36-week high, rising 4.60% on a week-to-week basis. It is the closest historical high among the four districts. The current difference is only 3.82%. The Kowloon property price index reported 179.55 points, up 0.58%, a difference of 4.85% from the historical high. The New Territories East property price index reported 194.38 points, up 0.97%, a 6.91% difference from the historical high. The New Territories West Property Price Index reported 169.78 points, down 0.75%, a 4.07% difference from the historical high.

In the past two months, the four major indexes have moved up repeatedly. Hong Kong Island gained 5 gains and 3 fell, a cumulative increase of 3.09%. Kowloon gained 6 gains and 2 fell, with cumulative gains of 2.38%. New Territories East gained 3 gains and 5 losses, with cumulative gains of 2.15%. New Territories West gained 4 gains and 4 losses, a cumulative increase of 3.70%.

Like