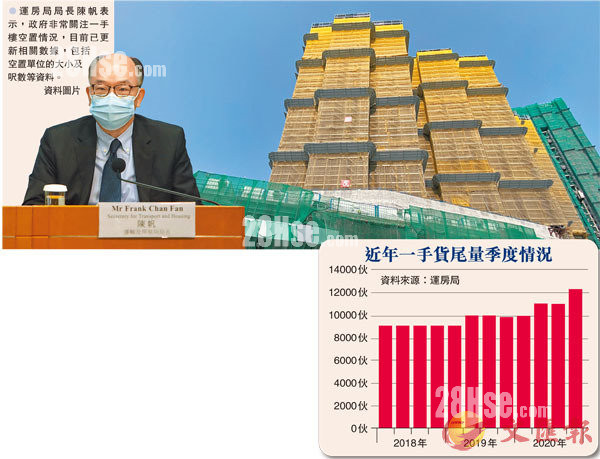

The Government withdrew the "Rates (Amendment) Bill 2019" commonly known as the "First-hand Vacancy Tax" in October last year. However, in response to the recent increase in the number of new stocks, some Members were concerned at the special meeting of the Finance Committee of the Legislative Council yesterday. Will the government relaunch. In response, the Secretary for Transport and Housing, Chen Fan, said that the government is very concerned about the vacant situation of buildings and will make policy arrangements after understanding the actual situation and does not rule out the possibility. According to data from the Transportation and Housing Bureau, first-hand cargo tails increased by 24% or 2,400 units year-on-year to 12,300 units at the end of last year. reporter Yan Lunle

In October last year, the government took into account the latest economic situation and balanced the considerations of all parties. It announced the withdrawal of the draft and temporarily shelved the introduction of the "first-hand vacancy tax." However, the relevant measures are still on the government table. Chen Fan recently stated that the government is very concerned about the vacancy of first-hand buildings. The relevant data has been updated, including the size and number of square feet of vacant units, and policy arrangements will be made after the actual situation is known. It does not rule out that the current situation will be reintroduced in the first-hand vacancy tax.

Small units increased by 42% to 4400 units

When the Transport and Housing Bureau responded to Members’ enquiries yesterday, it listed relevant data. As of the end of December last year, the remaining unsold first-hand private properties (completed but unsold units) totaled 12,300 units, compared with the end of 2019. The number of 9,900 units increased by 24%. Among them, the surplus of small units accounted for 4,400 units, accounting for 34% of the overall proportion. The number was also an increase of 1,300 units from the 3,100 units at the end of 2019. The increase was the largest among the five types of units, with an increase of 42%. Industry insiders pointed out that due to the impact of the epidemic last year, many new listings were delayed in response to the implementation of the gathering restriction order, resulting in a rapid increase in the number of new listings.

The economy is poor under the epidemic, the industry is worried about the results

Knight Frank Executive Director and Head of Valuation and Consulting Department Lin Haowen pointed out that it is not a good time to restart the vacancy tax. One of the reasons for setting up the tax is to hope that developers can speed up the sale of properties and reduce stockpiling. However, the current economic situation in Hong Kong is poor and unemployment. The rate is high. I don’t believe that the current vacancy tax will help drive down property prices and increase purchasing power. Moreover, he believes that the vacancy tax will have a greater impact on luxury homes and super luxury homes. Under the current economic situation, the re-introduction of the vacancy tax will not help speed up the supply.

He opposes suggesting that the government relax or abolish SSD (Extra Stamp Duty) to increase second-hand supply, to prevent buyers from flocking to the first-hand market, and to help owners with cash flow pressure to cash out or reduce debt. He said that if the government really reintroduces the vacancy tax, developers will be more cautious in buying land, especially land for luxury homes.

According to the information, the "first-hand property vacancy tax" is one of the "Six Tips for the Property Market" proposed by Chief Executive Carrie Lam in 2018. The specific content includes the amendment to the "Rates Ordinance". Developers are required to declare the issuance of an occupation certificate for 12 months or For the unit status of the above first-hand real estate, if any unit has not been sold after completion and has not been rented out for more than half a year in the past 12 months, an additional rate equal to twice the rateable value shall be levied

Like