The catastrophes of the century strikes, and it seems to have met before.

Notable events in the world will always happen twice, the first time in the form of tragedy, and the second time in the form of comedy. After a lapse of 17 years, Hong Kong is attacked by the epidemic of the century. It is inevitable to evoke the Hong Kong people's 2003 SARS memory. At that time, there was a unit in Amoy Gardens sold at a meager price of HKD550,000. The property price index has fallen only by 8.2% in the past over ten months, and there were only a few transactions with a large-scale price cut in the market, even in the problematic epidemic situation. It is believed many citizens have a question: What is the Hong Kong property market trend in this similar epidemic situation? Will there be a significant adjustment? The invites many experts to analyze the possibility of the future development of the property market for three consecutive days.

Journalist: Lai Chi-Tin, Yan Haau-Ling, Ma Chui-Mei

We are in a new era. From a scientific point of view, everything can happen, for example, New York oil futures of May fell to negative 40 dollars for the first time in the history of last Tuesday. "Only you can't imagine, nothing is impossible." Similar to the epidemic situation in 2003 at the time of SARS, will the property market have a different ending this time? According to the point of view of experts, there are six significant differences between the overall environment of Hong Kong's property market today and that of SARS. It is expected that there will not be a SARS-style collapse. However, the leading market is in a downward trend. From time to time, there would be shocking cheap houses in the market, which are mainly houses under "breathe Plan" or high-percentage mortgage, and pseudo luxury properties in various districts. These owners struggled to buy their first houses, and have to sell properties at low prices under unemployment and financial difficulties.

The first difference: the Hong Kong government vigorously rescues the market.

The strength of the global bailout this time is by no means comparable to the SARS period. Hong Kong government was unable to rescue the market when SARS outbroke, since the epidemic was concentrated in Asia, and Hong Kong's finances were weak. Hong Kong saves the market with powerful force this time. It uses large-scale counter-cyclical measures, totaled nearly HKD290 billion and equivalent to about 10% of the gross value of production, to support enterprises, and ensure employment. It pays salaries for the affected industries for half a year, which benefits 1.5 million people based on the monthly upper limit salary at HKD9,000. Besides, the government deliveries an allowance over HKD7,500 to more than 1.7 million people, creates another 40,000 jobs to ease the unemployment situation, and introduces different measures to support the unemployed people from no income. Many large organizations and private organizations have also funded and helped massively, which did not happen in SARS.

The disease affects not only Hong Kong but also the whole world. The major central banks around the globe all tried their best to release funds, and the United States also relaunches the unlimited QE. The market generally expects that the global market will be full of funds, which will flow into fixed assets, including the property market. The past three consecutive rounds of quantitative easing in the United States have driven up property prices in Hong Kong. Also, the expectation that interest rates will remain low for a long time. So, it is believed that the effect of unlimited QE in the United States will still have a specific impact on stabilizing the Hong Kong property market.

The second difference: the enterprise's self-rescue ability is enhanced.

At the time of SARS, Hong Kong had not yet walked out of the trough hit by the 1997 Asian financial turmoil. The economy was at a low ebb, and the market was already sluggish. After the ravages of SARS, SMEs had weak coping capacity; there was no online shopping, no takeaway apps, and even no government's help for salary. Thus the unemployment rate was as high as 8.7%, and the economic and financial risks were transmitted to the property market, leading the property prices to fall by 70% from the top level in 1997, with more than 100,000 negative assets. Many enterprises can still maintain certain economic activities through the application of WFH (working at home) through technology this time; The online shopping and takeaway platforms help the retail and catering. Although facing the difficulties of high shop rents, the industry refers to that online shopping and takeaway help businesses to rise by 10% to 15%, which has dramatically reduced the loss compared to the nearly zero income during the SARS period.

The third difference: There are different economic cycles.

In the year of the SARS, Hong Kong had just experienced the 1997 financial turmoil and the burst of the internet shares stock bubble in 2000. The stock market and property market plummeted, the private wealth evaporated, enterprises had large-scale layoffs and wage reductions, and the government had recorded a fiscal deficit for three financial years, with weak finance. In 2003, Hong Kong 's financial reserves fell to only about HKD260 billion. At that time, deflation even occurred. Civil servants were cut wages twice since February that year. The economy is at the bottom of the downward cycle. Finally, relying on the opening of personal travel in the Mainland and the import of foreign forces such as the US QE in 2008, the economy and the property market rebounded.

At present, the Hong Kong government's finance is unprecedentedly abundant. The financial reserves are still more than HKD800 billion, which is three times that of SARS, even the cost of this time is up to HKD290 billion. The personal travel in Mainland, stock market interconnection, Guangdong-Hong Kong-Macao Greater Bay Area and economic assistance in the Mainland like "the Belt and the Road" have continued. The economic cycle is in a period of high consolidation. This year, civil servants enjoy a salary increase of 4.75-5.26%. Hong Kong 's fundamentals are not weak if there was no effect of trade wars and social events last year.

The fourth difference: the property market can withdraw the strict measures and inject momentum.

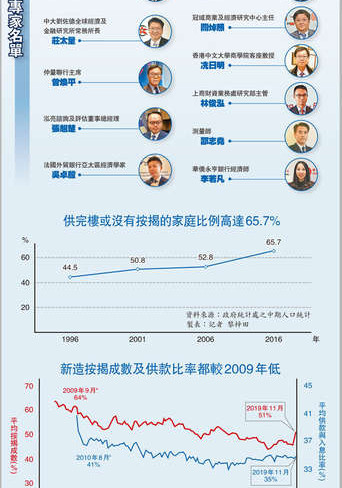

Strict measures intend to suppress the market demand and cool the property market. Nowadays, strict measures, in turn, serve as a shield for the property market, making panic selling challenging to appear in the residential market, and avoiding a plunge in the property market today due to speculation. The first property market strict measure is introduced in October 2009, setting a mortgage ceiling of 60% for residential properties valued HKD200 million or above, and maintaining the mortgage ceiling of 70% for properties valued lower HKD200 million. Still, the maximum loan amount is not more than HKD12 million. Over the past decade, property market strict measures have intensified. Buyers are mostly users and long-term investors, the proportion of whom with paying off the housing mortgage is higher than that of SARS, so they don't need to sell the property at a bargain. At the same time, "withdrawing strict measures" will become another measure pushing up the property prices. It may not make a substantial increase in property prices under the epidemic, but it can slow down the property price decline. The government could only defend the property market by stopping land sales and reducing supply the years after the SARS. Today, the government has more room to revive.

The fifth difference: Mainland funds cannot be ignored.

At the time of SARS, there was no mainland capital to come to Hong Kong to buy properties, and there was no Shanghai-Hong Kong Stock Connect or Bond Connect. Mainland funds began to increase their purchases in the Hong Kong property market around 2015. During the depreciation of the RMB in 2016, a large number of mainland funds poured into the Hong Kong property market, and transactions from mainland funds once had accounted for 30% in some first-hand housing projects. Later, the mainland funds expanded to markets of shops, entire buildings, or even land. Mainland funds are also considered to be a driving force for the rise of the Hong Kong property market.

Under the current epidemic, the mainland has issued money to save the economy. Mainland residents worry about the depreciation of the RMB and inflation, and property prices in some cities have already risen. Mainland investors will turn to non-RMB assets if there are expectations of RMB devaluation. The property market and wealth management products in Hong Kong will be options for them. The Hong Kong government will withdraw the strict measures, including SSD, BSD, and DSD, to clear the barriers for mainland funds and Hong Kong people to buy a second house, if the property market in Hong Kong is abysmal.

Besides, mainland investors buying Hong Kong stocks through hkwolun has a stabilizing effect on the Hong Kong stock market and the financial industry. A booming stock market can also drive wealth effects. Statistics show that as of April 22, the southbound funds, that is, mainland funds, through the hkwolun, net purchases of Hong Kong stocks amounted to RMB1,303.611 billion.

The sixth difference: other factors continue to work.

In recent years, the HKMA has raised various requirements for banks, and at the same time, has strictly regulated mortgage applications, including setting ceilings for mortgage percentages and stress tests. The financial status of borrowers under higher thresholds is relatively more stable than in the past. The latest default rate of residential mortgage loans in Hong Kong in March was 0.03%, which was much lower than that in the 2003 SARS period of more than 1%. As of November last year, the average mortgage to income ratio in residential mortgage loans that newly approved was only about 35%. The real mortgage interest was only about 2.5% at the same time. The sharp decline of property prices in 2003 SARS was the reflection of the property bubble in 1997. The mortgage to income ratio was as high as 100%, and the highest mortgage interest rate was nearly 20% in 1997. The ratio of mortgage to income fell to about 22.2%, and the real mortgage interest was about 2.5% in SARS.

Under the epidemic, banks also introduced an "Interest Only" arrangement for corporate customers and individual customers, which was also not happen in SARS; besides, the current proportion of owners who had paid off the mortgage is over 60%. Thus, owners will not sell the property with no reason or sell it cheap.

Under a similar epidemic situation but a different macro-environment, will the property market have a different ending this time?