It is equal to 3 times the average household income, and each unit is HKD1.01 million.

Hong Kong property prices continue to be the world's top. Demographia, a research agency, yesterday announced Hong Kong had become the world's most challenging city to afford property prices for ten years in a row. And the ratio of property prices to average household income is as high as 20.8 times, which means citizens have to save money without any expense for 21 years to buy a house. While the average property price is up to HKD7.04 million, the average property price should fall to HKD1.014 million, which is 86% lower than the current average property price to be considered as "affordable," according to the definition that three times is an affordable level.

(By Ngan LunLok)

Demographia, a research agency, recently released the 2019 international housing affordability report, which shows that Hong Kong has become the most challenging city to afford housing prices in the world for ten consecutive years.

This research agency classifies affordability into four categories, and Hong Kong belongs to the highest level of "Severely Unaffordable," with the ratio of property price to average household income as high as 20.8 times, which is still staggering even it has slightly lower than 20.9 times in 2018.

Citizens have to save money for 21 years without any expense to buy their first house.

According to information, the ratio to measure the affordability of housing prices is calculated by dividing the average property prices in a city by the annual average household income, and the higher the value, the worse the affordability. According to the latest figures in Hong Kong, it takes 20.8 years for a family without any expense to be able to afford a house. Based on the data of the third quarter of last year, the survey covers eight countries, including Australia, Canada, China, the United Kingdom, the United States, and so on, with 309 cities in total, and Hong Kong is the only Chinese city in the survey.

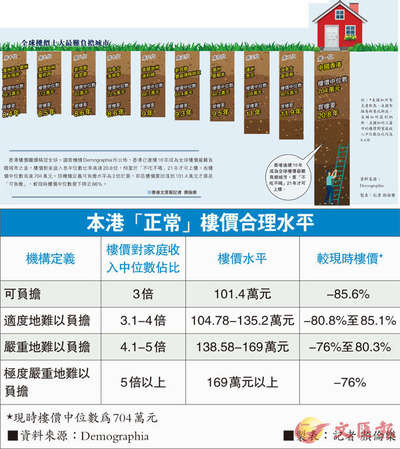

According to the affordability defined by the agency, the ratio of affordable property prices to average household income should be three times or less. Thus the property price level should be HKD1,014,000 to be the healthiest, calculated by the average household income in Hong Kong of HKD338,000. While the current average property price is HKD7.04 million, which is 5.94 times higher than the health level, and it is the worst in the world. The ratio of property price to average household income is up to 20.8 times, far away from 11.9 times in Vancouver, Canada, which is the second, and 11 times in Sydney, Australia, which is the third.

It criticized that waiting for public housing is too long.

It means the average property price has to fall to HKD4.022 million if the ratio in Hong Kong wants to fall to the same of 11.9 times in Vancouver, which is the second. According to the report, the high property prices in Hong Kong are closely related to the lack of supply. Since the 1970s, the Hong Kong government has controlled the amount of new land and restricted the development of green belts, and high property prices are related to this environment. It also criticized the long application time of public housing in Hong Kong. The average waiting time of general applicants is 5.4 years (last June's data).

The report refers directly that the Hong Kong property market has a bubble, but not the top of the global bubble, while the Toronto property market in Canada is the most bubbly in the world. This agency believes the Government is trying to improve the supply shortage and the affordability of the public, and the land supply task force proposed plans such as reclamation in 2018 to increase the supply of houses. Besides, some private developers also donated or lent part of agricultural land to deal with the shortage of house supply.