12,900 units had been completed in the first eleven months last year, and there is still a gap of 7,490 units from the target.

(By Ngan Lun-lok)

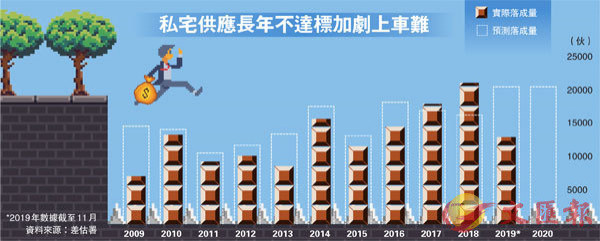

Although the property market has fallen recently, while the complete number of private houses also decreases. According to the latest information from the RVD, as of November 2019, the complete number of private houses was only 12,925, a gap of 7,490 units or 37% from the annual target of 20,415 units, achieving 63% of the target. The insiders point out that the slowdown in the completion of private houses has kept supply and demand in a relatively balanced state under the effect from Hong Kong policy amendment crisis, unclear economic outlook, and the decreased market demand, so the property prices will not fall sharply in the short term, but it is worry that the property prices may sharply rise if the market situation restores to steady while the accumulated supply is failed to meet the demand after many years.

The RVD announced yesterday that the complete number of private houses in November 2019 was only 749, down 64% from October of 2,076 units. As for the cumulative completions in the first 11 months of 2019, there were only 12,925 units, which is far from the predicted target of 20,415 units, which is only 63% of the target. In other words, the number of completions in December must be 7,490 units to reach the target, which is almost an "impossible task", so the situation of not achieving the target in the year is predictable.

Plus there is serious hidden trouble of lack supply.

The Managing Director of Wang Leung Consulting and Evaluation, Cheong Kiu-chor expresses, the cumulative completion amount last year was only about 12,900 units, and Government had reduced the annual private land supply to 12,900 units, then it can be inferred that the construction and completion in the next few years will continue to decline, leading the annual private land supply after 3 to 4 years to fall to only 7,000-8,000 units, which would be a very dangerous sharply gap.

He believes that the completion of private houses has slowed down, but instead has stabilized the property market, and property prices will not fall in the short term. The publics' desire to buy a property is relatively reduced because of the current social turmoil and uncertain economic prospects, but the purchasing power exists. Moreover, the world is facing a situation of "currency depreciation and asset appreciation", while Hong Kong has down market because of internal contradictions. If the market conditions gradually stabilize after a few years, and the low-interest-rate environment continues, coupled with the maturity of the development of the Greater Bay Area, then the demand for assets may explode under the stimulation of the surrounding market, and property prices in Hong Kong may rise sharply.

Knight Frank: This is a critical year for supply.

The Executive Director and Valuation and Advisory Department Director, Lam Ho-man expresses, the current abundant property inventory and future new projects, factors of Government policy and first-hand property vacant taxes, etc., and the recent social turbulence have slowed down the first-hand property sales, also the market needs time to deal with, thus developers slow down housing construction. Besides, he believes the lack of short-term completion will not have a large effect to the property market, and it is estimated that the residential housing supply in the next 3 years will be enough although the completion drops, but there would be a problem after 2023, so 2020 is a critical year.

Analyzing the completion volume of 2019 as of November, the completion rate of small and medium-sized units is the slowest, with the completion for Class B in 431-752 sq ft only 4,166 units, a gap of 2,667 units from the target of 6,833 units, and the compliance rate is only 61%. While the completion for Class A under 430 sq ft was only 6,062 units, a gap of 3,739 units from the target of 9,801 units, and the compliance rate is also only 62%. As for the larger units of Class C and D, the compliance rates were 71% and 75% respectively, and only 224 units of the largest Class E were completed, with the compliance rate of 62%.

It is expected the supply of small-sized units would be 11,900 this year.

Besides, Jones Lang LaSalle points out in the "Residential Sales Report" announced yesterday that, it is expected the units completed this year will be mainly small-sized units, with number for the Class A under 430 sq ft in about 11,900 units, accounting for 55% of the total supply, and the volume will reach a 10-year high. However, buyers of units under HKD10 million can apply for a mortgage of 80-90% under the new mortgage restrictions, so the company predicts buyers may turn to larger units, then developers would be further softened on pricing for the first-hand properties to sell more inventory units.