The resumption of quarantine-free travel between the mainland and Hong Kong has driven gradual improvement of the local economy, and the property market is reaping the benefits. Morgan Stanley issued a report yesterday stating that the trend of interest rates and the return of full customs clearance are two major factors that continue to benefit the market.

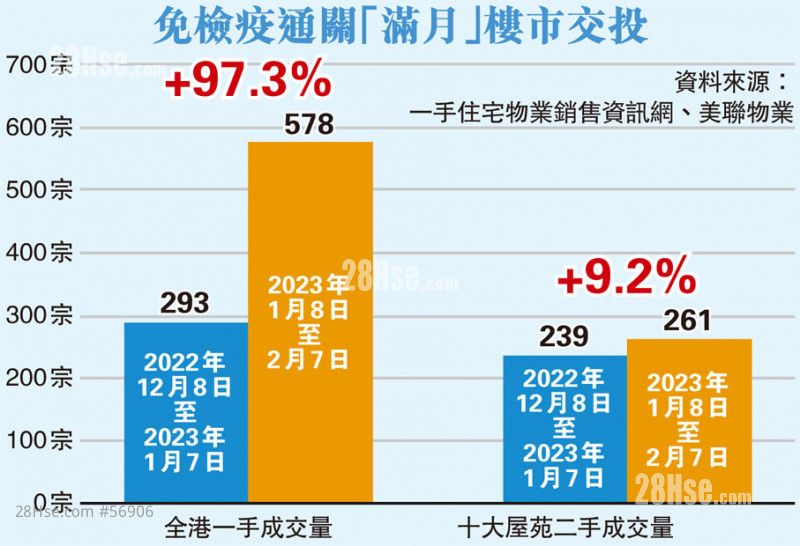

The property price forecast exceeded the original estimate of a 5 per cent, rising to a rebound of 10 per cent. At the same time, the target prices of many Hong Kong real estate stocks have been raised by about 10 per cent on average. According to property agency statistics, the mainland and Hong Kong implemented the first phase of quarantine-free customs clearance from January to early February. Moreover, the first-hand and second-hand transactions in the market increased by 97 per cent and 9 per cent respectively month-on-month. Tsang Yip-chun

Morgan Stanley pointed out that Hong Kong's property prices have rebounded by about 2 per cent in December last year after falling 18 per cent from a peak. The investment banking giant is optimistic about the outlook of Hong Kong's property market, and has raised its residential price forecast from 5 per cent to 10 per cent this year, following a rebound in property deals, improved market sentiment, and interest rates.

Hong Kong's annual retail sales expected to rise by 15 per cent

The bank also forecast that with the return of full customs clearance, the number of tourists visiting Hong Kong will rise to some 70 per cent of February, 2018, by the end of the year, and purchasing power to return to about 40 per cent in the same period of 2018. Therefore, the Hong Kong retail sales growth forecast for this year is expected to increase from the previous 9 per cent to 15 per cent, while the retail market is expected to rebound by 5 per cent rentals this year. In addition, the bank expects office property markets to stagnate this year, with a vacancy rate of 12 per cent – the highest since 2003. New office space of 2.1 million square feet is to be completed this year, which will hinder the recovery of the property rental market.

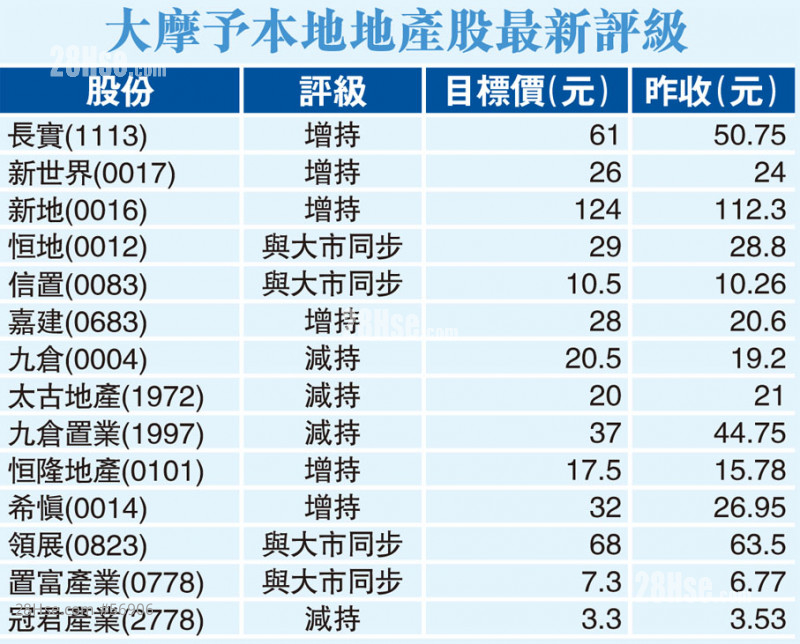

The share price of property stocks has risen by 15 per cent in the past two months. According to Morgan Stanley, the current valuation is reasonable, discounted by about 50 per cent to the net asset value per share (NAV) and a dividend yield of more than 5 per cent. Most real estate developers will still maintain stable dividend payouts, among which Cheung Kong (1113), Swire Properties (1972) and Fortune REIT (0778) are expected to increase dividend payouts. Simultaneously, the industry is expected to continue to be re-rated and valuations to rebound. Morgan Stanley adds that the property sector remains attractive, with the residential real estate market, wth the residential market most favored, followed by retail, and office buildings. (See attached table for the latest target price of relevant shares).

The housing market plays catch up

Since January 8 of this year, the mainland and Hong Kong implemented the first phase of quarantine-free customs clearance. Within exactly a month, the Hong Kong economy has gradually returned to normal, and the overall residential property market has picked up, according to Sammy Po, chief executive officer of Midland Realty's home division. Since the announcement, investment confidence has risen significantly and the Hong Kong stock market has seen a growth of more than 50% from its rounding bottom. Following the full reopening of borders, the property market played catch up. With a simultaneous rise in price and transaction volume, first-hand residential transactions saw the biggest increase. About 578 transactions were recorded in the month of February 7, a sharp increase of about 97 per cent month-on-month (MoM) compared with the 293 transactions in the previous month. In the same period, the transactions of the top ten second-hand housing estates also increased by 9.2 per cent monthly to 261. Po added that as interest rates are about to peak and stabilize, the property market will maintain momentum in February and March, and prices will continue to rise.

Property agents anticipate budget surprises

Dave Ma, chief executive officer of Hong Kong Property Services (Agency), also pointed out yesterday that the resumption of full customs clearance will effectively drive the economic recovery of Hong Kong, and interest rates are expected to peak this year. With the support of good news, developers will speed up the pace of launching projects, which will bolster buyers’ purchasing power in the market. It is expected that many large-scale first-hand properties will be launched in the first quarter. Ma added that the property market would maintain momentum. The number of first-hand transactions expected to be recorded is 4,000, a quarterly increase of nearly 4 times. Similarly, second-hand transactions have boomed, with top 20 housing estates recording 274 second-hand transactions in the first four weeks of the year, an increase of about 11.8 per cent from 245 in the previous four weeks.

Ma also predicted that the number of second-hand housing registrations in the first quarter of this year will exceed 10,000, an increase of about 30 per cent quarterly. Should this month’s budget be generous, it is expected that the property market will see a greater breakthrough in the middle of the year, and the annual increase in property prices is most optimistic up to 15 per cent, contributing to the trend of rising price and transaction volume. Recently, the bank’s inquiry volume has increased tenfold compared with the same period last year, and the number of mainland buyers entering the market has also increased by two to three times annually.

Like 5