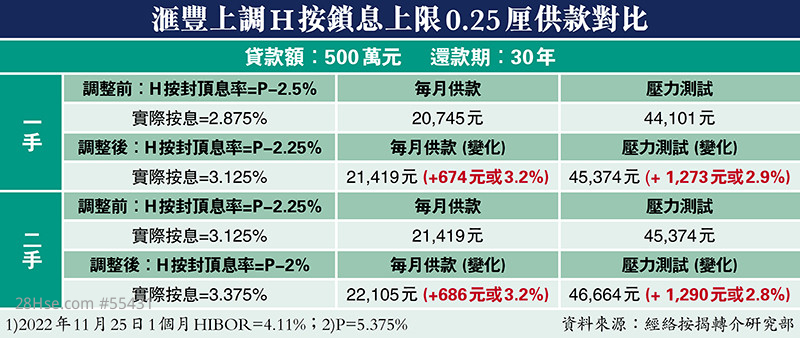

Increase the cap interest by 0.25% and increase the monthly supply of 5 million by nearly 700 yuan

As the end of the year draws near, banks are in tight water. One-month interest rates have been higher than 4% for 2 consecutive days. The inversion between mortgage interest rates and bank capital costs has intensified. It is rumored that the leading bank HSBC will further increase the interest rate mortgage plan for first-hand and second-hand properties (H Press) The capped interest rate is 0.25%, which will take effect on December 6. Calculated by borrowing 5 million yuan for 30 years, if the bank’s first-hand and second-hand properties adjust the new mortgage rate, the monthly payment will increase by about 674 and 686 yuan compared with the previous month. According to the industry, based on the fact that the interest rate hike of the leading bank is an indicator, it is expected that other banks will follow up with the H mortgage interest rate increase before raising the interest rate (P) next month. As the interest rate continues to rise, home buyers need to carefully weigh their repayment ability.

◆reporter Yan Lunle

According to the announcement made by the Association of Banks yesterday, the 1-month HIBOR related to real estate mortgages rose for 10 consecutive days and rose to 4.10958% yesterday, staying above 4% for 2 consecutive days. In addition, the interest rate of some fixed deposits has exceeded 4%, which reflects that the capital cost of banks has exceeded the mortgage interest rate. It is reported that HSBC will raise the capped interest rate of H mortgages for first-hand and second-hand properties by 0.25% on the 6th of next month, from 2.875% to 3.125% for first-hand properties, and from 3.125% to 3.375% for second-hand properties.

The new adjustment is planned to be implemented on the 6th of next month

Take HSBC's current prime interest rate (P) of 5.375%, and take a loan of 5 million yuan and repayment for 30 years as an example. The actual mortgage rate of the first-hand property is 2.875% before H is adjusted according to the capped interest rate, the monthly payment is 20,745 yuan, and the stress test requirement is 44,101 yuan. After adjustment, according to the capped interest rate of 3.125%, the monthly contribution will increase by 674 yuan or 3.2% to 21,419 yuan, and the stress test requirement will increase by 1,273 yuan or 2.9% to 45,374 yuan.

As for the second-hand property, H is 3.125% before adjustment according to the capped interest rate, the monthly payment is 21,419 yuan, and the stress test requirement is 45,374 yuan. After the adjustment, the capped interest rate of H is 3.375%. The monthly payment increases by 686 yuan or 3.2% to 22,105 yuan. The stress test requirement is 46,664 yuan, an increase of 1,290 yuan or 2.8% from before. This large-scale bank adjustment is limited to the new mortgage applicants of the relevant banks, and the old mortgage customers who are already mortgaged are not affected.

Cao Deming, chief vice president of Meridian Mortgage Referral, said that the market expects the Federal Reserve to continue to raise interest rates by 0.5% at the meeting next month. Under the linked exchange rate system, the gap between Hong Kong and US interest rates will further widen. Depending on the trend of bank balances, the range is about 0.25%.

Other banks are expected to follow suit

He believes that HSBC expects the trend of interest rates, and in response to capital costs and profits, will raise the upper limit of the H mortgage interest rate again, andPrepare for rising interest rates. Looking back at the two months before Hong Kong’s interest rate hike in September this year, many banks have successively raised the upper limit of the H mortgage interest rate. It is expected that other banks will follow suit and raise the upper limit of the H mortgage interest rate before raising interest rates next month.

The market is expected to emerge to apply for the last bus

Wang Meifeng, managing director of Centaline Mortgage, also believes that the interest rate increase in Hong Kong next month will not be less than 0.25%, and the actual interest rate will rise to 3.5%. Since the adjustment of the interest rate by the leading bank is indicative, it is expected that other banks will follow suit and raise the interest rate of new mortgages. As the new adjustments will only take effect on December 6, it is expected that the market will immediately experience the last train effect of speeding up the submission of new mortgage refinancing applications, and users who need to attend the meeting will speed up the submission of mortgage applications.

Wang Meifeng also pointed out that this cycle of interest rate hikes is still milder than in the past for the time being, but because Hong Kong has experienced an ultra-low interest rate environment for more than ten years, the increase in interest rates this year has reached 2% from 1.5% at the beginning of the year to about 3.5% at the end of the year However, since the actual interest rate of 3.5% is still lower than the average interest rate of about 4.3% in the past 30 years, it is believed that the pace of interest rate hikes will slow down next year, and users can absorb the impact of interest rate hikes.

Like