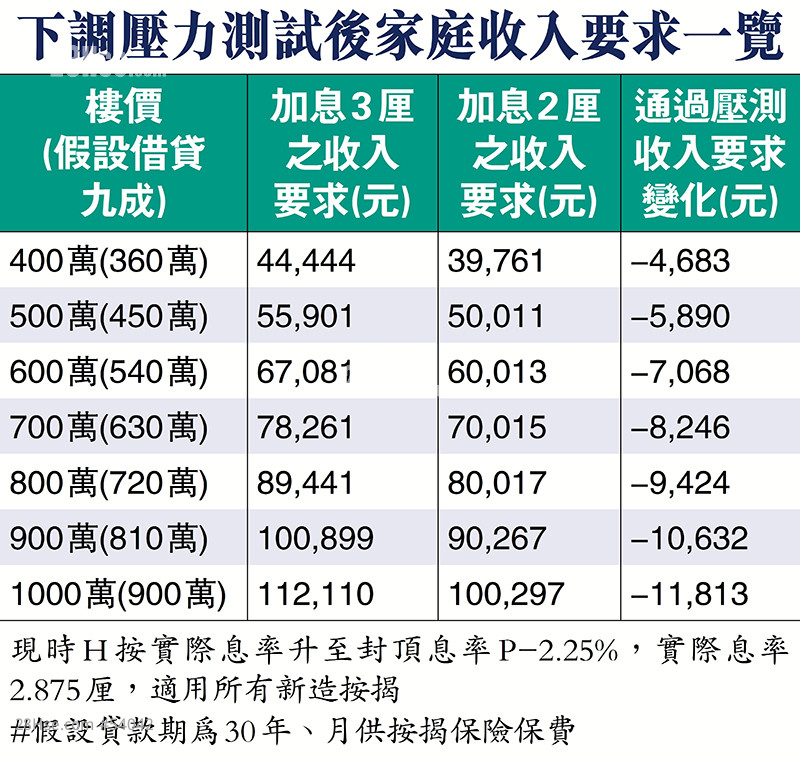

She also said that the Hong Kong P was only increased by 0.125% this time, and the market expects that the rate hike cycle may peak next year. It is believed that the cumulative increase in Hong Kong interest rates will not keep up with the US interest rate, so the pressure test assumption is reduced to 2%. It has provided sufficient defensive power for the property owners, and it can also protect the bank credit risk from increasing. This time, the HKMA responded quickly to the changes in the market. It is believed that it will help home buyers prepare their budgets and prepare for the interest rate hike period, and it will also prevent buyers from becoming more difficult to enter the market when the interest rate increases, which will positively promote the property market.

In 2010, the HKMA required banks to conduct stress tests for mortgage applicants, and in 2013, the assumed rate hike for the stress test was raised from 2% to 3%.

Like 8