Users and investors all enter the market, and developers will soon push for 3.5 billion

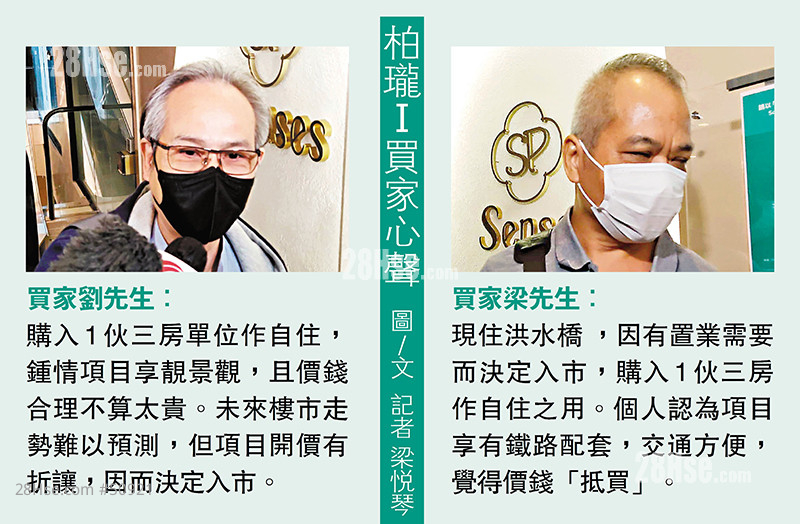

The epidemic in Hong Kong has eased, and the atmosphere of the property market has improved. The low market price is 10% launched, and it has accumulated nearly 13,500 votes. This year’s Yuen Long Kam Sheung Road Station Park Long I launched the first round of 388 units yesterday, and the queues reappeared. Users and investors When they entered the market, some big buyers spent more than 29.43 million yuan to buy 2 units with three bedrooms and a studio (including toilets). All the units were sold out after 7.5 hours after the sale. The cash flow exceeded 3.5 billion yuan, and the highest transaction price per square foot was 20,550 yuan. The developer immediately added 168 units last night, with an average price per square foot of HK$18,776, a slight increase of 1% to 1.5%. ◆reporter Liang Yueqin

The off-the-plan construction period is about two and a half years. There are 715 units of Perlon I developed by Sino, K. Wah, China Overseas and MTR. The first round of 388 units were sold yesterday, with an area of 354 to 763 square feet, including one to three bedrooms. Prices range from 6.079 million to 14.507 million. Yesterday's sales were divided into Group A and Group B. Group A is the period for large buyers to purchase flats. They need to buy at least 1 unit with 3 bedrooms, and can buy 3 units at most. Group B buyers can buy up to 2 units.

Blockbuster units sold out in 1.5 hours

The reporter saw it outside the Empire Centre in Tsim Sha Tsui at 8:45 a.m. yesterday. Group A buyers have already entered the venue one after another. The developer has set up a number of anti-epidemic arrangements, including setting up a 1.5-meter distance at the gathering location, requiring a group of 4 people, and scanning "Safe Travel" before entering the venue. As for the buyers of Group B, who entered the venue at different times from 11:30 in the morning, many prospective buyers waited in line, resulting in long queues.

168 units will be added to the price increase in the evening

Tian Zhaoyuan, co-director of Sino Land Sales Department Group, said that in the first 1.5 hours after the sale of Bailong I, 69 units were available for sale in Group A (61 units were available for three-bedroom units), including 20 groups of buyers who bought 2 units each. The highest investment involved is about 29.434 million yuan, and 2 units with three bedrooms and a set of workshops (including toilets) were purchased. At the same time, many of them are family tourists, reflecting the confidence of buyers in Hong Kong.

The sales were satisfactory. Last night, the property launched 168 units with an area of 339 to 769 square feet, including one- to three-bedroom partitions. After deducting the maximum 16% discount, the discounted price was RMB 6,450,300 to RMB 14,906,000, and the average price per square foot was RMB 18,776. Add 1% to 1.5%.

Bu Shaoming, CEO of Midland Realty's Residential Department (Hong Kong and Macau), said that the bank's customer attendance rate reached 90%, 60% were young people born in the 1990s, and 30% were investors. The bank had three groups of big buyers during the A-group period, and one group spent RMB 27,005,000 to purchase a three-bedroom and a two-bedroom for investment. Another group of customers spent RMB 24.026 million to purchase a three-bedroom apartment and a two-bedroom apartment, and the rental return is expected to be more than 3%.

24 million self-users purchased 2 units in a row

Chen Yongjie, vice chairman of the Asia Pacific region and president of the residential department of Centaline Properties, said that the bank's customer attendance rate reached 80%, and about 70% were users. During Group A, the company has about 10 groups of 20 large-scale customers. Among them, one group of customers spent about 24 million yuan to buy two units, one is a three-bedroom with storage room and the other is a two-bedroom with storage room, which are family customers. For own use. He also pointed out that factors such as huge user demand and depreciation of silver paper have made the market demand for property investment to preserve value and self-use.

Like