Campton additionally launches houses today at the soonest. Vanke points out that customers' focus on this project is many.

The National People's Congress votes on the National Security Law Related to Hong Kong Area today. Some agents believe that the relevant measures have little impact on the property market since there have been more than 300 first-hand property transactions in the past few days since the news announcement. Vanke Hong Kong's The Campton, a project in Cheung Sha Wan and launched at prices lower 20% than market level, with 8,699 applications, put on sale the first round of 188 units at 8:30 in the morning yesterday. The market source points out that all had been sold out by 6 pm the same day, cashing in over HKD1.4 billion. The developer will launch more today at the earliest. Wing Tai' OMA by the Sea in Tuen Mun additionally launched 88 units yesterday. The discounted average sq ft price is HKD13,746, and the discounted lowest cost is HKD4.396 million. All these units will be put on sale on Sunday.

Journalist(Leong Yuet Kam)

The Campton put on sale the first round of 188 units since 8:30 am yesterday. Developer arranged 13 periods for housing selection in response to the restriction of gathering. According to on-site sources, the attendance and buyers' proportion was quite high yesterday. The first buyer had signed the contract at 9:50 this morning.

Centaline and Midland point out that investors account for 20%.

The APAC Vice President and Residential Department President of Centaline Property, Chen Wing-Kit expresses that the prospective buyers' attendance of their company was up to 80%, with 20% of investors, who mainly want to counter the currency devaluation caused by the Quantitative Easing. The Chief Executive of the Midland Real Estate Residential Department, Po Siuming, expresses that the customer attendance was about 80%, buyers after 80s and 90s accounted for about 70%, and investors accounted for 20%.

The Executive Director of Vanke Hong Kong, Chau Ming-Hei, expresses that they would launch more today at the soonest since the sales were hot and the potential buyers are many. It is reported that the unit sold for the highest price was Room A on the 8th floor in 761 sq ft, with the price at HKD12.7115 million; the unit at the highest sq ft price was Room M on the 29th floor in 287 sq ft, with the sq ft price at HKD20,519. There are 5 groups of customers buying more than one unit.

OMA by the Sea launches 88 units more.

Yesterday, Wing Tai' OMA by the Sea in Tuen Mun additionally launched 88 units, which are one-bedroom to three-bedroom units in 338-886 sq ft. The discounted prices are HKD4.396-13.396 million, with the discounted sq ft prices at HKD12,798-15,163. All these units will be put on sale on Sunday.

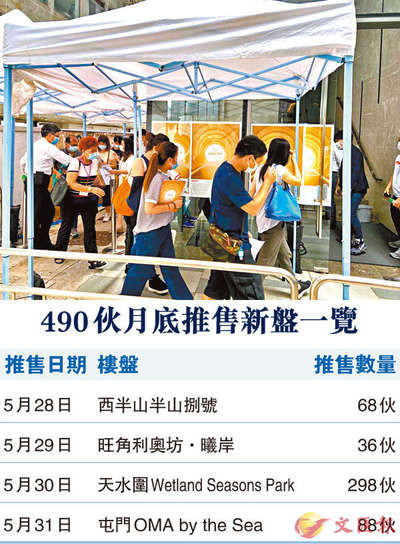

Four projects will sell 490 units publicly at the end of the month.

The sales of first-hand property are hot this month. From today to the end of this month, there will still be four new projects selling 490 units. Po Siuming believes that the property market is more affected by factors such as the economic environment, interest rate, and supply, and the effect of political events is relatively slight. Market purchasing power is focused on the first-hand property market as more and more new projects are launched. It is expected that the trading volume in May may reach about 2,200 units, a record high of nearly a year.

Chen Wing-Kit also is positive on the first-hand property market and predicts 2,200 transactions in a month, a one-year high. He also estimates property prices to rise slowly drove by the volume of sales. CCL may exceed a new high above 190 points. He points out that there have been more than 300 first-hand property transactions in the past few days since the announcement of the news. It reflects the measures will have little impact on the property market. He also believes that the relevant legislation may have a more significant impact on investors' mentality. Still, the current demand for the first-hand property is from first housing customers and users. So, the effect will be little.