Amendment Crisis continues, affecting the Hong Kong property market.

Since the Amendment Crisis continued in the second half of last year affecting Hong Kong's business activities, plus the Sino-US trade friction affected the Hong Kong economy, thus the transactions of Hong Kong commercial buildings in last whole year had fallen over a half, and the rental and sales prices end up with falling. A statistical report points out that, the sale prices for class A and B commercial buildings have respectively fallen by 6.1% and 5.7%, while the prices decline for class A commercial building in Queensway was even up to 18%, the highest in Hong Kong. The analysis suggests, negative factors will continue to affect the market, but Hong Kong's status as a financial center is estimated to continue and will support the commercial market driven by China Concept Stocks, thus it is predicted the trend of office building market this year will fall and then stabilize.

(By Ngan LunLok)

According to the report of Midland Non-residential Properties Department, the market performance of Hong Kong commercial buildings has experienced steady and then falling, and the rental and sales prices of commercial buildings had sharply fallen also the transactions had largely dropped in the second half of the year due to the impact of the deteriorated market situation. Plus with transfers of companies over HKD100 million, the transactions of commercial buildings last year were recorded of 962 cases, sharply down 53.9% year-on-year than 2,089 cases in 2018, the new low since 1996, and the transaction was only HKD4.669 million, down 59.9% yearly.

The rental and sales prices fell. Hong Kong Island has declined over Kowloon.

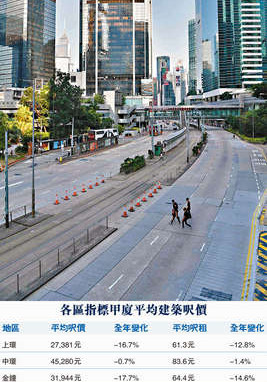

By districts, the rental and sales prices of several commercial core areas were "falling" last year, and the Hong Kong Island, which was most affected by the Amendment Crisis, performed worse than Kowloon. Among them, the decline in Queensway is the most. The latest average sq ft price of index class A commercial buildings in the district is HKD31,944, down 17.7% year on year, and it is the worst performance in all districts, returning to the level at the end of 2017. The current average sq ft price of class A commercial building in Sheung Wan is HKD27,381at Sheung Wan tower a is $27,381, down 16.7%, the second-worst in Hong Kong.

On the contrary, the average sq ft price of class A commercial building in Tsim Sha Tsui benefited from the high-speed rail traffic effect, fell only 3% last year, while East Kowloon rose 3.7% more against the market, performing better than Hong Kong Island area and being the only district that recorded a rise against the market. However, the declines of some areas of Hong Kong Island were relatively small, such as Hong Kong Central District and Wan Chai, the average sq ft price declines of class A commercial buildings of which fell only 0.7% and 0.9% last year. According to the insiders, the index class A commercial buildings being put on sale in partial from these two districts were small, and most are owned by powerful owners, different from the areas with more investors in Hong Kong Central District, Admiralty, etc., thus the price did not decline significantly due to the stronger owners.

It is worth noting that the rental performance of Queensway and Sheung Wan Districts last year also performed worse than the decline of the overall commercial buildings of 5.7%, with accumulative declines of 14.6% and 12.8% in the whole year, respectively, ranking the first two declines in Hong Kong, and the rental returned to the mid-2017 level.

The Chief Operating Officer and Commercial Director of Midland Non-residential Properties Department, Yung HungCheung points out that, the prices of Class A commercial buildings in Hong Kong Island core areas like Sheung Wan and Queensway have sharply fallen since Murray Road land site was sold for high prices in 2017, with the range larger than that in Kowloon, thus when the market situation was adjusted last year, the decline in the core area of Hong Kong Island was also higher than that in other areas.

The continuous return of China Concept Stocks supports the market.

Looking forward to this year, he believes that although the market will still be plagued by local "political events" and rising unemployment rate, also the mainland pneumonia incident and the tension in the Middle East will affect the market atmosphere, investors should not be too pessimistic about this year's commercial market. Recently, he said, there were sources that China Concept Stocks including Baidu and Nets planned to return to Hong Kong for listing, which is an important contribution to Hong Kong's continued role as an international financial center and support the office market.

He predicts that the trend of the rental and sale prices of class A commercial buildings this year will first fall and then stabilize, with the prices will fall about 5% in the whole year, and the rental price is expected to fall about 5% to 8%.