The low-limit and upper-limit of land price valuations are quite different, from HKD1.74 billion to HKD5.41 billion.

(by Li Zitian)

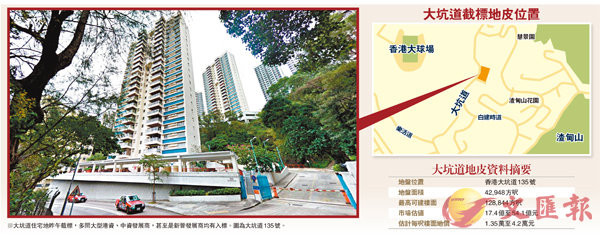

At the time of the property market's pullback, large scale land was recorded being sold at a price lower than market level, while small scale Hong Kong Island urban area land attracts fierce competition from developers. The application for Tai Hang Road residential land launched by Lands Department in Jardine's Lookout was closed yesterday noon, and the market reaction is active, receiving 25 tenders that are the most for official lands since April 2018. The tenders include a number of large-scale Hong Kong-founded and Chinese-funded developers, and even newer developers have entered the bid, of which Hong Kong Construction is the first time in land investment. The low-limit and upper-limit of market valuations of this land are quite different, ranging from HKD1.74 billion to HKD5.41 billion, and the floor area sq ft price is about HKD135,000 to HKD42,000. Some surveyors estimate that it can be built into a mixed-type luxury project, and the sq ft sale price is expected to be above HKD38,000 after completion.

Developers in sole proprietorship include Cheung Kong, Henderson, Wharf, Great Eagle, Kerry, CITIC Pacific, Chinachem, Nan Fung, K&K Property, Grand Ming, Chinese Estates Holdings Limited, Tai Cheung Properties, China Overseas, KWG Property, Hong Kong Construction, Orion Land (separated by SEA Holdings), Wing Tai Properties Limited, etc., and Sino is partnered with Lai Sun Development and K.Wah to form a consortium to enter the bid.

Buyers can apply for changing a title deed in the future.

The land site is located in inland lot No. 9076 at 135 Tai Hang Road, Hong Kong, and it is currently a senior civil servants quarters in about 42,900 sq ft, with the floor areas of the lowest and highest floor in 77,300 sq ft and 128,800 sq ft respectively. According to the land sale regulations, the winning consortium will need to lay a section of the public road on the west side of the site within the specified period and be responsible for the repair and maintenance of the southeast slope. The Executive Director and Corporate Development Director (valuation and property management) of Pu Jin, Cheong Shing-dium stated earlier that the land sale regulations also mentioned that the buyer can apply to the Lands Department in the future to modify the restrictions on the building area in the lease, further improving the development potential of this lot.

Developers grab Hong Kong Island seascape lands.

Hong Kong Construction Manager (Company Secretary) Lai Kam-kui said that the group is mainly engaged in the development in Mainland and has confidence in the prospects of the Hong Kong property market, so enter the bid in sole proprietorship, also it is the first time for the group to bid for official land, hoping to open Hong Kong real estate market. The Administrative Manager of K&K Property, Lam YeeWah expresses that the group bid in sole proprietorship because it believes that the site is in a good location and had sea views also is still optimistic about the future market development since the site will be completed in a few years later, while the group will be more cautious on pricing. The Project Manager of Grand Ming, Tsang Ka-man expresses that this time they bid in sole proprietorship because Hong Kong Island has few seascape land sites and the bid was within a reasonable range, also the group is optimistic about the property market in the long run.

The Executive Director of Tai Cheung Properties, Lee Wing-sau expresses that they bid in sole proprietorship this time, and the land is located in a luxury residential area with open seascape, plus the Sino-US trade war recently is progress, also the social movement has begun to stabilize, so it is believed Hong Kong is a blessed land and the property prices are expected to develop steadily early next year. When asked there is a foreign company predicts the luxury house prices will fall by 20%, Lee Wing-sau disagrees and points out that the social atmosphere has improved and the property market still is supported by the low-interest environment, while the current bid is still more prudent.

There is an analysis pointing out that the possibility of failure of bid is small.

The Executive Director and Director of the Valuation and Consulting Department of the Knight Frank, Lam Ho-man expresses the number of bidders was greater than expected, reflecting the developer's desire for a "quality land" and the confidence in the luxury market. He estimates that the cost of the land site will not be too low, and the opportunity for failure of bid will be small since it is located in Hong Kong Island luxury real estate area. Some units can enjoy the Victoria Harbour sea view. It is believed that developers "do their own counts", and the bids for this land are estimated will not be too conservative, also developers are definitely interested in it since the investment amount is not large and the location is traditional luxury house lots although there are factors such as social movements and vacant taxes.

Lam Ho-man estimates that the sq ft floor area land price is about HKD16,000-22,000, the total price is about HKD2.1-2.9 billion, and the total investment is about HKD3.5-4 billion, also the sq ft price is expected to be HKD38,000 after completion, besides the bid price will have an index effect on the property price in the district. He expects the project is able to be built into a mixed luxury project including about twenty-floor high-rise buildings and some low-density houses or villas, but the disadvantage is that the transportation and living facilities are general, also it needs to deal with substation which will increase costs and time.

Due to the good response to the bid, the Centaline Property Real Estate Surveyor, Cheong King-tat yesterday raised the floor area land price valuation by 33.3% to HKD20,000 from about HKD15,000, leading the latest valuation to about HKD2.58 billion.