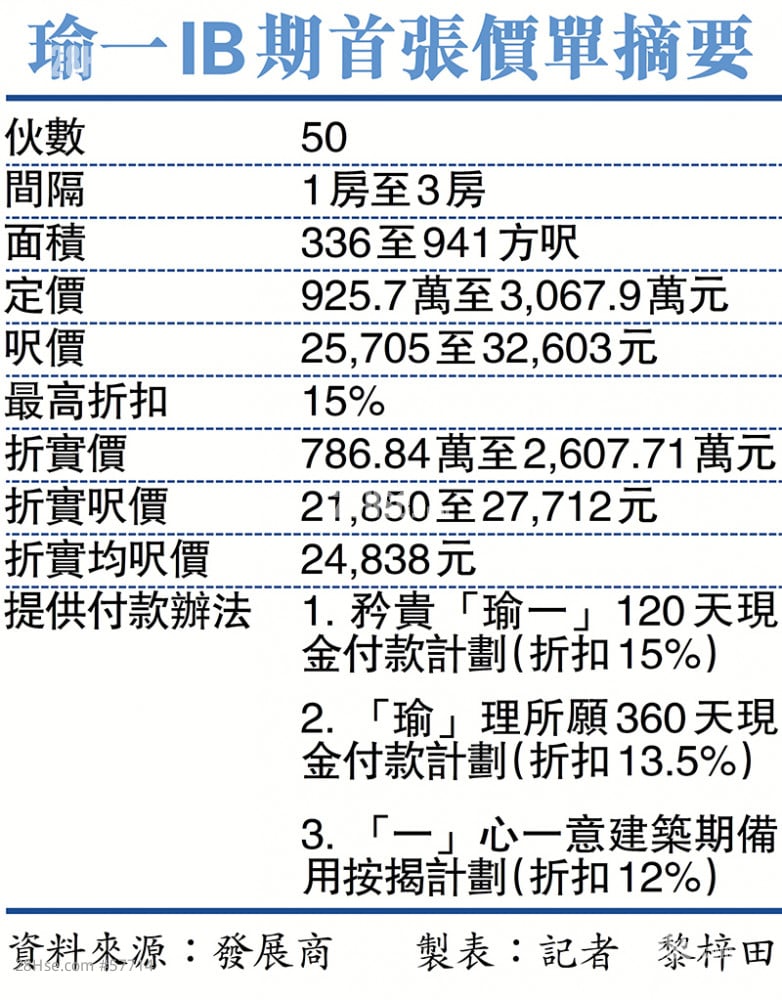

First batch of 50 units, starting from HK$7.87 million at 336 square feet, to go on sale next week at earliest

Since the full resumption of cross-border travel between Hong Kong and the Mainland, first-hand properties continue to be put up for sale. The first 50-unit price list for Phase IB of In One above Ho Man Tin Station, a joint development between Chinachem and MTR, was launched yesterday, comprising one- to three-bedroom units at a discounted price of HK$7.8684 million per square foot. The developer described the opening price as affordable and will open sample flats and collect tickets this Friday, with sales starting next week at the earliest. At present, most of the second-hand properties in Ho Man Tin range from HK$18,000 to HK$21,000 per square foot. Meanwhile, Ultima, a luxury property adjacent to In One, has recently been priced at around HK$35,000 per square foot. Compared with the first batch of Henderson’s THE HENLEY II in Kai Tak, which was launched last year at a discounted average feet of HK$24,300, the price per square foot of In One is similar to that of new Kai Tak developments.

Lai Chi-tin

According to Chinachem, the first price list of the project consists of 50 units, including six one-bedroom, 33 two-bedroom units, and 11 three-bedroom units, ranging in size from 336 to 941 square feet. At a maximum discount of 15 per cent, the real price ranges from HK$7.8684 million to HK$26.0771 million, with an average price of HK$24,838 per square foot. According to the price list, all one-bedroom units are discounted to less than HK$10 million, with units starting at HK$7.8684 million for a 1-bedroom (open kitchen) 336-square-feet unit. The developer added that the total value of the price list is HK$850 million.

Tickets to be collected on Friday, more units to be promoted before sales launch

The last new development on top of the Wong Chuk Hang MTR station to open for sale was Kerry Properties’ La Marina in August 2021, with its first batch priced at a discounted average of HK$30,880 per square foot. According to agency information, the recent second-hand average price per square feet in Ho Man Tin ranges from HK$18,000 to HK$21,000, while the recent average price per square feet in the neighbouring luxury residential estate, Ultima, is around HK$35,000. Compared to Wheelock’s MONACO MARINE in Kai Tak, where 111 units were put up for sale on Friday (17 March) at an average price of HK$25,743 per square foot, the price per square foot of In One units and new developments in Kai Tak is similar.

Helen Fung, sales director at Chinachem Group, said that the project price considered market demand and launched the first batch of units at a price close to market price. She also described the current asking price as extremely reasonable, with room for price increase in the future. Furthermore, Fung expressed optimism towards the project’s sales performance. The project will open show units and collect tickets on Friday, with more units to be launched before the sale, and the sale will start as soon as next week.

Centaline: Sales price close to cost price

Connie Chan, Chinachem's general manager of sales, said that the first batch of price lists will be offered with three payment plans, including the exclusive “IN ONE” 120-day cash payment plan (15 per cent discount), the “IN” Your Wish 360-day cash payment plan (13.5 per cent discount) and the "ONE" Heart Standby Mortgage Loan Stage Payment Plan (12 per cent discount). Buyers who choose the Build-to-Pay option can apply for a 80 per cent loan-to-value mortgage from the developer with a repayment period of no more than 360 months.

Louis Chan Wing-kit, vice chairman and chief executive of Centaline’s Asia Pacific Department (Residential), described the opening price as "advertised" and said the developer was offering the first batch of flats at lower prices in the hope of attracting more customers. Chan added that the lack of large-scale projects above the railway in urban Kowloon in recent years made it difficult to compare with first-hand units in the same district, while the lack of one-bedroom flats in the secondary market in Kowloon Tong and the old age of the buildings also make direct comparison difficult. The first 50 units are expected to be sold at an attractive price and should be “cleared in one quarter”, which will freeze the HK$10 million secondary market in Hong Kong.

Chan Wing-kit believes that the collapse of the Silicon Valley Bank in the US has triggered the market to lower the forecast for the US interest rate hike in the US next week. It is expected that the interest rate will be raised by only 0.25 per cent or even no hike, which is good news for the Hong Kong property market. Hong Kong banks actively seized the mortgage market as several major banks in Hong Kong lowered their cap rates, which will benefit homebuyers the most.

Investors to account for 40 per cent of the market

The developer's first batch of units are priced at "shocking prices" and are expected to steal the spotlight, according to Sammy Po Siu-ming, chief executive of Midland Realty’s Hong Kong and Macau Residential department. He added that the developer adopted a strategy of selling all units first before increasing prices in future launches. The In One project is located above the MTR Ho Man Tin station and the first units are attractively priced with a 20 per cent discount, compared to other second-hand projects in the same area. This is expected to attract many users and even investors. It is estimated that investors will comprise a 40 per cent share.

SHKP sells HK$177 million units in Mid Levels East

In terms of transactions, the luxury housing market recorded large transactions. Sun Hung Kai Properties’ (SHKP) CENTRAL PEAK on Stubbs Road in Mid-Levels East sold the Manor B unit on the 5th floor of Alpex III (with a parking space) at a price of HK$177 million by tender. The 2,080 square-foot, four-bedroom, two-suite flat is priced at HK$85,096 per square foot.

Like 14