(By Ngan Lun-lok)

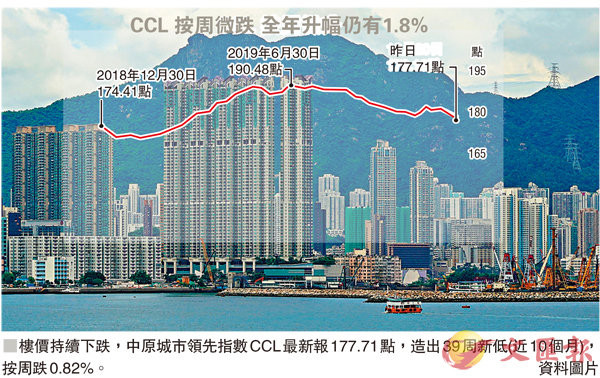

Property prices continue to fall, and the latest property price index fell to a new low of nearly 10 months. According to the data of the Centaline Property Research Department, the Centa-City Leading Index (CCL) is latest reported at 177.71 points, creating a 39-week (nearly 10 months) new low record, and it declines 0.82% weekly. Although the property price indexes rise, the CCL increase narrows to 1.84% annually. As for the type of property that has experienced a decline throughout the year, it is CCL (large units), which temporarily fell 0.25% this year.

The Senior Co-director of Centaline Research Department, Woo Leung-sing expresses, since the announcement date, the CCL (large units) has fallen by 0.25% in 2019, and it is the first index in the eight leading property price indexes to fall. The rest of the indexes rose slightly this year. CCL has risen 1.84%, CCL Mass has risen 1.98%, and CCL (small and medium-sized units) has risen 2.26%. As for indexes in the four districts, Hong Kong Island rose 2.95%, Kowloon rose 0.91%, New Territories East rose 4.12%, and New Territories West rose 0.91%.

Most types of properties fell weekly.

While the latest figures released by the company show that the property price indexes of most types decline weekly. The CCL (large units) is 175.44 points, a new low in 40 weeks and down 0.72% per week. The CCL Mass is 179.47 points, a new low in 40 weeks and down 0.83% per week, also it is the biggest decline in 14 weeks. The CCL (small and medium units) is 178.15 points, a new low in 39 weeks and down 0.84% per week, also it is the biggest decline in 14 weeks.

Woo Leung-sing believes that the trend of luxury property prices has weakened significantly, falling by 3.36% for five consecutive weeks. In the eight weeks after the announcement of Policy Address, CCL (large units) has fallen 6 weeks and risen two weeks, with the accumulated decline of 3.01%. It is worth noting that, the three major CCL overall indexes fell below the level before the Government relaxing the property price upper limit of mortgage insurance. In the eight weeks since the Policy Address was announced, CCL has fallen by 0.73%, CCL Mass has fallen by 0.15%, and CCL (small and medium-sized units) has fallen by 0.27%. The overall property prices continue to adjust to downward, and the CCL may decline to 170 points.

In terms of the four districts, Hong Kong Island has the largest decline this week to the latest 187.81 points, a new low in 7 weeks and down 1.99% per week, also it is the biggest decline in 14 weeks. Kowloon property price index is reported at 174.17 points, a new low in 40 weeks and down 0.54% per week. New Territories West property price index is reported at 161 points, a new low in 41 weeks and down 0.73% per week. New Territories East property prices index is reported at 188.53 points, up 0.38% per week.

The house visiting activities decrease in various districts. According to the statistics of the Midland Real Estate Branch, in the last weekend of 2019 (December 28 to 29), the number of houses visiting appointments in 15 index housing estates is recorded of about 372 groups, down by about 9.3% weekly. The Chief Executive of the Midland Real Estate Residential Department, Po Siuming expresses, many owners and customers go away for vacation on weekend as the new project sales are about to start and the coming New Year's Eve and New Year's day, resulting in a weak second-hand property market sentiment, which will affect the house visiting activities on weekend to fall all lines.

The house visiting volume of the ten leading housing estates on the weekend fell 9% by week.

The house visiting appointments in ten leading housing estates through Centaline Property on this weekend are 430 groups, down 9% from that of last week. The APAC Vice President and Residential Department President of Centaline Property, Chen Wing-kit expresses, the house visiting activities will inevitably be affected since some owners and buyers have left Hong Kong for vocations during the Christmas and New Year holidays, plus developers start to launch projects actively, attracting a lot of potential buyers to visit sample flats on holidays and distracting the attention to the second-hand property market, so it is estimated the overall second-hand property trading volume will remain low on the weekend.

The Ricacorp Properties Research Department Director, Chen Hoi-chiu expresses, the company estimates 1,185 groups of customers to visit houses in 50 indexing housing estates in Hong Kong on this weekend, and the number falls another 7.4% by week, also it has declined for two weeks. The recent market conditions show stalemate. It is believed that there will be a notable improvement after the New Year's Day of the soonest.