(Journalist Ma Chui-Mei)

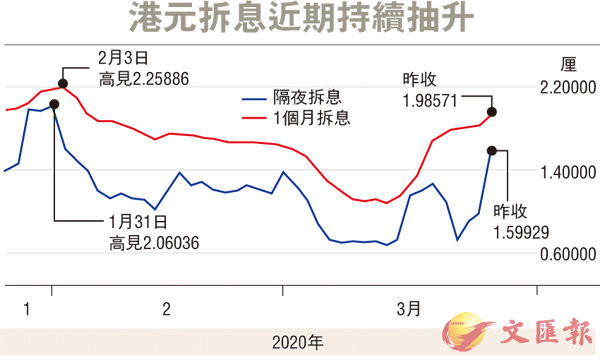

The quarterly settlement days are approaching, and market liquidity is tightening. Hibor has risen across the board for three consecutive days, and it has risen to about 1.599929% overnight. The one-month Hibor related to property mortgage interest rates rose nine times by nearly 11 points to 1.988571%. Both are new high for almost two months. Some analysts believe that although the US Federal Reserve has cut interest rates twice and introduced unlimited quantitative easing, the economic outlook under the epidemic is uncertain. Besides, Hong Kong banking pursuits the book performance as the coming of quarterly settlement days, and there are also arbitrage activities under the widening of the Hong Kong-US interest rate spread, etc., leading the Hong Kong dollar liquidity to tighten. So, it is estimated Hong Kong dollar interest rates may fall following the US dollar interest rates after the end of the quarterly settlement days.

Hibor has risen across the board for three consecutive days. The short-term interest rate hike was particularly evident. The one-week and two-week interest rates rose above 2% yesterday to 2.08464% and 2.00845%, and the three-month Hibor rose to 1.80857%. For long-term interest rates, the semi-annual Hibor rose to 1.81804%, and the one-year Hibor rose to 1.83274%. In terms of the Hong Kong-US interest rate spread, the one-month Hibor yesterday increased to 1.988571%, increasing the interest rate spread with LIBOR over the same period to about 1%.

DBS Bank estimates HKMA may need to collect money.

Hong Kong dollar exchange rate hovered at a strong range around 7.75 yesterday. Wong Leung-Heung, the Managing Director of Financial Capital Department of DBS Bank, expresses that the Fed 's interest rate cut to near-zero has further widened the Hong Kong-US interest rate spread. And it prompts more covered interest arbitrages in the market and supporting the Hong Kong dollar exchange rate in a strong range around 7.75. He expects that the Hong Kong Monetary Authority may intervene in the Hong Kong dollar exchange rate in the future if the covered interest arbitrage continues. However, the possibility of collecting money will not be too large.

Lee Yeuk-Fan, an economist of OCBC Wing Hang Bank, said that the US Federal Reserve 's earlier measures such as Quantitative Easing had eased the tightness of the US dollar 's liquidity. However, the liquidity released by the measures will take time to be transmitted to all parties. It is believed that the market's risk aversion is still high in the short term under the expanding epidemic. The market may continue to chase and hoard US dollar cash, and the US dollar index may continue to fluctuate.

OCBC: Hong Kong interest rate declines with the US interest rate.

In Hong Kong, Lee Yeuk-Fan points out that Hong Kong banking pursuits the book performance as the coming of quarterly settlement days, which increased the demand for Hong Kong dollars and further pushed up the Hong Kong dollar interest rate. However, she believes that as the liquidity of the US dollar becomes higher, the Hibor will fall following the Libor after the end of the quarterly settlement days. She reminds us that the balance in the current Hong Kong banking system has fallen to about HKD54 billion, which may increase the fluctuation of Hibor and cause a relatively small drop at the same time.

As the Hibor rises across the board, another bank introduced discounts for the Hong Kong dollar time deposit to lock the cost of capital. Yesterday, Chiyu Banking raised the 38-day Hong Kong dollar time deposit rate, and the annual interest rate increased from 0.48% to 2.08%. It may have HKD216.5, saving a minimum requirement fund of HKD100,000 for a 38-day Hong Kong dollar time deposit. This bank also introduces a 98-day Hong Kong dollar time deposit with an annual interest rate of 2.23%, and the lowest requirement fund also is HKD100,000.

Dah Sing Financial estimates pressure on future net interest margin.

The fluctuation of Hong Kong interest rates also affects the performance of banks' net interest margins. Wong Pak-Ling, the Executive Director of Dah Sing Bank (0440), who released the announcement yesterday, expresses the notice of recent fluctuations in Hibor under the decline of US interest rates. Wong also estimates Hong Kong interest rates may decrease affected by the slow down of credit demand and growth in the next months. The Managing Director of Dah Sing Bank (2356), Wong Cho-Hing, expresses that the bank’s net interest margin was suppressed mainly by the fluctuations of Hibor last year. The Bank net interest margin may decline due to the Fed ’s interest rate cut. Wong points out that the bank will actively adjust deposit and loan portfolio, and strive for more low-interest deposits, to maintain a stable level of net interest margin.